The research report pointed out that the national real estate policy has been frequent recently, and soda ash, as one of the main varieties in the industrial chain of real estate completion, has attracted market attention. Recently, the continuous futures price of soda ash has increased significantly. Soda soda is one of the core varieties of real estate chain. In the past two years, the pattern of industry supply and demand has changed greatly, mainly reflected in the rapid concentration of industry production capacity to the first two enterprises and the rapid increase in the proportion of photovoltaic demand. The balance between supply and demand of the industry in the next three years is calculated. Generally speaking, it is considered that the comprehensive operating rate of the industry will remain above 85%, and the soda ash market is expected to remain active, and the overall situation will be easy to rise and difficult to fall. Industry head enterprises and related flexible targets still deserve long-term attention.

CITIC Jiantou | Soda: the core variety of real estate chain, there are still many opportunities under the new pattern.

Soda soda is one of the core varieties of real estate chain. In the past two years, the pattern of industry supply and demand has changed greatly, mainly reflected in the rapid concentration of industry production capacity to the first two enterprises and the rapid increase in the proportion of photovoltaic demand. We calculated the balance of supply and demand in the industry in the next three years. Generally speaking, we believe that the comprehensive operating rate of the industry will remain above 85%, and the soda market is expected to remain active, and the overall situation will be easy to rise and difficult to fall. Industry head enterprises and related flexible targets still deserve long-term attention.

Recently, the national real estate policy has been frequent, and soda ash, as one of the main varieties in the industrial chain of real estate completion, has attracted market attention. Recently, the continuous futures price of soda ash has increased significantly.

Although soda industry is a traditional industry, in fact, in the past two years, the supply and demand pattern of soda industry in China has changed greatly. On the occasion of the expected recovery of the real estate industry chain, this report mainly combs the supply and demand of the industry and the investment opportunities under this supply and demand background.

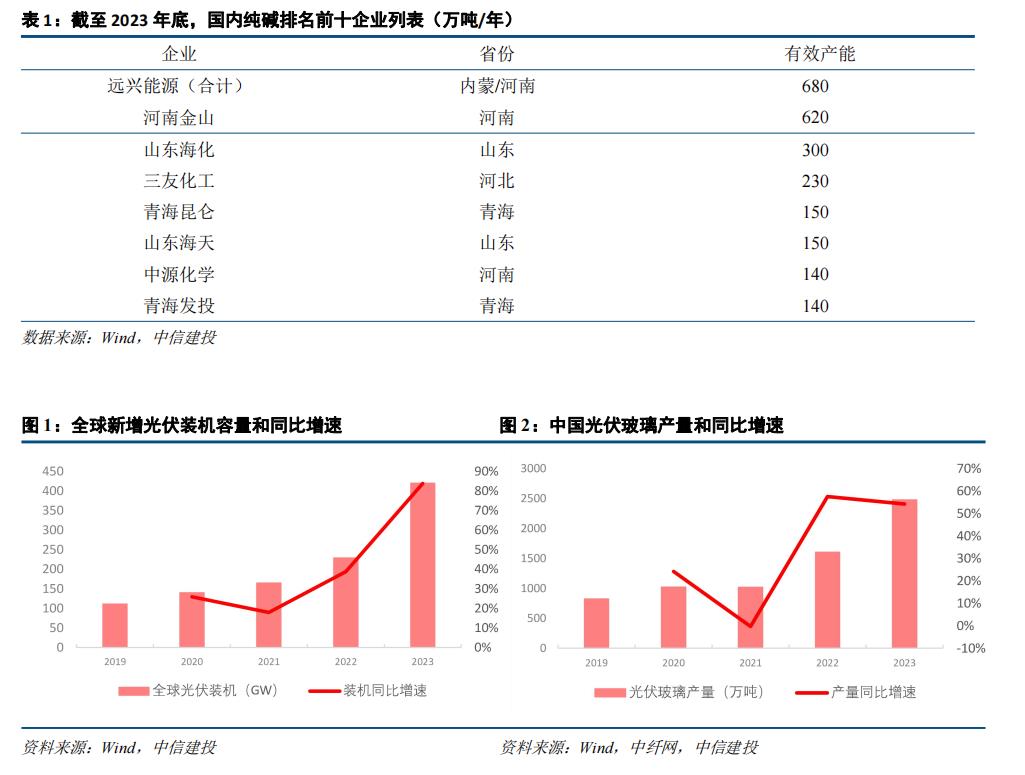

Supply side: Yuanxing and Jinshan lead the expansion of production, and the industry supply tends to be concentrated substantially.

In the past two years, the representative event of soda ash supply side is the concentrated expansion of production of head enterprises, in which 5 million tons of soda ash in Yuanxing Alashan Phase I began to be put into production gradually in 2023H2, and 2 million tons of soda ash was also put into production in Jinshan, Henan. The industry pattern has been greatly concentrated in the first two companies. In particular, Yuanxing Alashan is a natural alkali project, and its cost is obviously ahead of the industry average; Jinshan’s production capacity is combined alkali process, which also has a cost advantage compared with the ammonia-alkali process plant with the largest number of industries. Therefore, the industry cost curve has also changed greatly in the last two years.

Demand side: photovoltaic connecting rod demand support; Smooth end impact of flat glass link

Photovoltaic: the proportion of demand has increased significantly; Higher growth can be expected in 24 years. In the past two or three years, with the rapid expansion of the photovoltaic industry, the most significant change for soda ash is the significant increase in the daily melting amount of photovoltaic glass. As the vast majority of photovoltaic glass corresponding to the global installed capacity comes from China, in the medium and long term, the global installed capacity of photovoltaic glass is the most important factor (not the capacity of photovoltaic glass), as shown in the following figure. By 2024, the daily melting amount of photovoltaic glass has reached 100,000 tons/day, which is flat.

The daily melting amount of plate glass is close, which has become the most powerful support for the demand side of soda ash And in 2024, the global photovoltaic installed capacity is still expected to maintain a growth rate of around 25%, which will continue to push up the demand for soda ash.

Real estate: the completion of real estate fluctuates greatly, but the fluctuation of flat glass production is quite smooth, and because of the low base, even if the 24-year completion cycle is not good, it will not particularly impact the demand. The production of 1 ton of flat glass requires about 0.2 tons of soda ash, so the demand for soda ash at the real estate end is mainly reflected in the output of flat glass. However, the characteristics of flat glass that it is not easy to be cold-repaired, and once it is cold-repaired, it will be shut down for a long time determine that the starting load fluctuation of most production capacity in the industry is very small. As shown in the following figure, it can be seen that the fluctuation of the year-on-year growth rate of glass production in history is far less than that of the completed area of houses.

Even in 23 years, we also saw the reverse relationship between completion and flat glass output: the year-on-year growth rate of completion in 23 years reached +17%, but the year-on-year growth rate of flat glass was negative due to the high base in 22 years. In 24 years, the market generally expects the growth rate of real estate completion to turn negative, but we also have reason to believe that it is difficult for flat glass production to drop sharply under the 23-year base.

Balance between supply and demand: Below, we make a relatively simple calculation of the balance between supply and demand of soda ash-

(1) Capacity end: We assume that the large-scale production capacity under construction in soda ash industry, such as Yuanxing Alashan Phase II project, can be put into production as scheduled. And put in some small production capacity expectations (but irrelevant to the overall situation). Among them, there are two kinds of caliber: year-end capacity and annual capacity considering the release rhythm. If a certain production capacity reaches the end of June of that year, it will be counted as half of its total production capacity in the industry’s "annual production capacity considering releasing rhythm".

(2) Demand side: at the completion side, we assume that the decline in real estate completion in 2024 will bring about a decline in the output of flat glass of about 7%; On the photovoltaic side, we assume that the daily melting amount of photovoltaic glass will maintain a year-on-year growth rate of about 25% with the global photovoltaic installed capacity in 2024, but the growth rate will fall back to about 10% in 25 and 26 years. As can be seen in the following table, according to the above assumptions, even under the more pessimistic assumptions about the completion and flat glass (for example, assuming that the output of flat glass will decline by 12% in 2024), the demand for soda ash will continue to increase year-on-year in 24 years.

(3) In terms of inventory and import and export, it is assumed that the level of stability in normal years is basically maintained, which makes our attention focus on the long-term changes in the supply and demand pattern of the industry.

Based on the above assumptions, as shown in the following table, it is not difficult to find that if measured by the average operating rate of the industry, 2022 and 2023 will be the years with the tightest supply and demand in the industry, and the average operating rate of the industry is around 90%.In 2024, the expected growth rate of industry supply is greater than demand, and the industry pattern tends to be loose.

But even if the supply and demand of the industry tends to be loose, we think this does not mean that the soda industry is not worthy of attention. On the contrary, based on the following reasons, we believe that soda ash is still a high-quality plate worthy of continuous tracking in the next 2-3 years.

1. Head enterprisesThere is still a solid bottom profit, a low valuation level and a significantly improved dividend rate.

At present, the head enterprises in soda ash industry are not only producing 1.8 million tons of Zhongyuan Chemical and 5 million tons of Alashan soda ash, but also the total production capacity ranks first in the country. More importantly, as the only natural alkali manufacturer in the industry, the company has a high cost advantage in the industry. Under the background that the price of soda ash in 24Q1 has dropped obviously and the industry profit has deteriorated, there is still a profit level of 568 million yuan in a single quarter and 2.272 billion yuan annually. In the future, with the climbing of Alashan Phase I production capacity and the construction and commissioning of Alashan Phase II, there is still much room for improvement in production capacity, and the average cost per ton is expected to be further diluted.

On the other hand, it should be noted that the company greatly increased the dividend level in 2023, with the cash dividend amount reaching 1.119 billion yuan and the dividend rate (calculated by deducting non-net profit) of 46%. After the capital expenditure of Alashan Phase I and Phase II ends, the annual deduction of non-net profit and dividend rate may be further increased, and the feedback from potential shareholders is considerable.

2. It should be noted that the industry operating rate is still expected to be above 85% in 24 or 25 years, and the absolute level is still relatively high:

Our judgment on the supply and demand of the industry is based on the static analysis at the current time. However, unexpected supply and demand disturbances are likely to occur in actual economic operation. From the historical experience, when the comprehensive operating rate of the industry is above 85%, it actually has the basis for a substantial price increase with the cooperation of supply and demand. For soda ash, if there is an unexpected favorable supply and demand in 24 or 25 years (the real estate policy is more than expected, or the global photovoltaic demand is more than expected), there may be a sharp price increase in the short term.

Historically, according toIn 2018 and 2020, the comprehensive average operating rate of soda ash industry was around 83%, slightly lower than 85%, but there was a dramatic surge in the corresponding years.

3. The increasingly concentrated industry pattern will make soda ash easy to rise and difficult to fall, and the price may not really be close to the industry cost line for a long time:

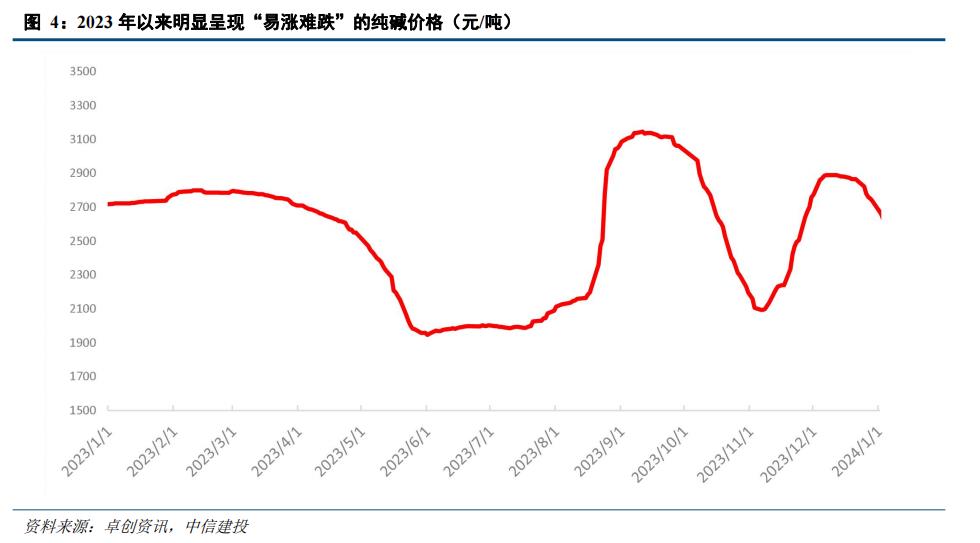

When a subdivided commodity industry tends to be oversupplied, a simplified way of thinking is "marginal cost pricing", that is, the price is likely to fall to or even fall below the full cost of the industry’s marginal capacity. This rule has been verified in most chemical products in history. But on the other hand, it should be noted that when the industry supply is increasingly concentrated in the head enterprises, commodity prices often deviate from the above laws. Specifically, it is gradually showing the characteristics of "easy to rise and difficult to fall" and "natural bulls". The logic behind it is that the price leadership of the industry leader and the bargaining power relative to the downstream have been greatly improved.

In fact, in 2023, we have already seen such a situation. With the commissioning of the Alashan Phase I project in Yuanxing, the leading position was established, and the price of soda ash was obviously easy to rise and difficult to fall:

We believe that in 2024, although the supply and demand of the industry will continue to become loose conservatively, the price of soda ash is probably not "honestly lying on the marginal cost line". For the leading enterprises in the industry, it is also likely to form a more favorable situation than "completely competitive market and marginal cost pricing".

4, soda standard often has a high stock price elasticity:

Our discussion mainly focuses on the fundamental level. However, from the performance of stock price, due to the deep binding between soda ash and real estate demand in history, and the active trading of corresponding futures varieties, the stock price elasticity of soda ash is often in the forefront in the chemical industry when the real estate is highly concerned.

1. Risk of deterioration of supply and demand in the industry: The biggest risk of the industry is to calculate from the balance of supply and demand. In the next two years, the industry may continue to experience the situation that supply and demand tend to be loose. Of course, this does not mean that the head enterprises in the industry will have serious performance pressure.

2. Downside risk of real estate: At present, the real estate policy is making efforts nationwide, but if the real estate industry is not repaired as expected, especially if the completion end is significantly less than expected, it may have a greater impact on it.

3. Risk of coal price fluctuation: regardless of ammonia alkali, combined alkali and natural alkali, coal price constitutes a considerable part of production cost. Therefore, if the coal price is greatly increased, it may greatly affect the production cost of soda enterprises.

关于作者