In addition to huge losses, NIO is getting deeper and deeper in the vortex of "autophagy" of gross margins.

The new power automakers in the first half of 2023 showed a trend of polarization, both in terms of delivery volume and performance.

Looking at the half-year performance of listed car companies according to the statistics of "Automotive K Line", only three car companies in the passenger car sector have experienced the phenomenon of "loss expansion", NIO and XPeng Motors occupy two of them, and they are also lossmaking. NIO’s situation is somewhat special.

1 Former "boss", today "hip pulling"

With the announcement of NIO’s second-quarter results on August 29, the former three giants of new forces "Wei Xiaoli" and the late-comer Zero Run Car both handed over the first half of 2023. Among the three giants of new forces who used to "remember the hardships and think about changes" together, Li Auto has already taken the lead in turning losses into profits and successfully entered the independent head camp. However, NIO, which was ranked first in new forces, has been left behind by Li Auto by a huge gap, and even inferior to the late IPO Zero Run Car.

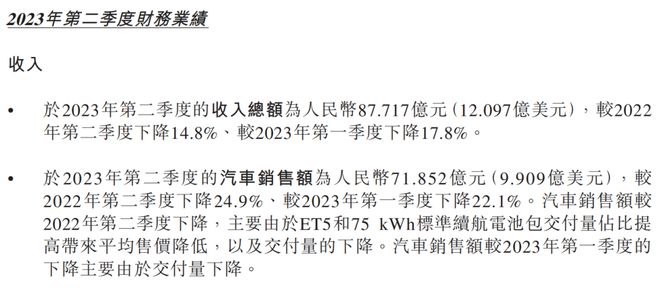

The second quarter results show that NIO’s operating income in the second quarter of 2023 reached 8.772 billion yuan, down 14.8% and 17.8% from the same quarter, lower than market expectations. Among them, automobile sales were 7.185 billion yuan, with a decrease of more than 20% from the same quarter.

In this regard, the explanation given by NIO is that the average selling price was reduced mainly due to the increase in the delivery of ET5 and 75kWh standard battery packs, and the decline in delivery also led to the decline in Quarter 1 car sales.

"The image is from the NIO announcement."

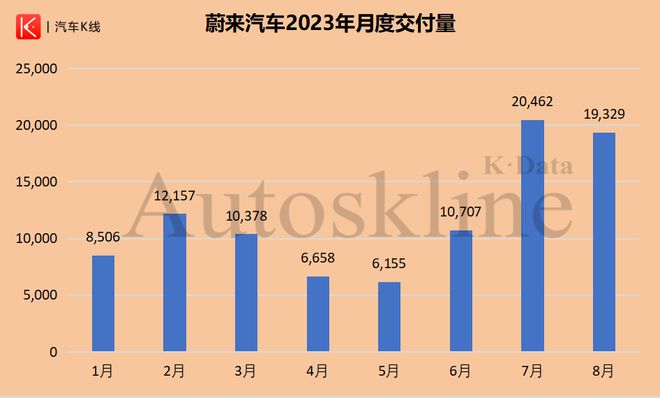

From the perspective of deliveries, NIO did experience a short-term slump in the first half of the year.

In the second quarter of this year, NIO delivered 23,520 vehicles, a decrease of 6.14% year-on-year and a decrease of 24.22% month-on-month; in the first half of the year, 54,561 vehicles were delivered, a slight increase of 7.35% year-on-year; after June, NIO deliveries gradually picked up and exceeded 20,000 vehicles in July.

Li Auto has continued to break through this year, and has delivered 139,100 vehicles in the first half of the year alone.

As for profits, it is also the case of "one family is happy and several are worried".

In the second quarter of this year, Li Auto’s net profit reached 2.31 billion yuan, an increase of 147.4% compared with Quarter 1, becoming the third new energy automobile company to maintain consecutive quarterly profits after BYD and Tesla.

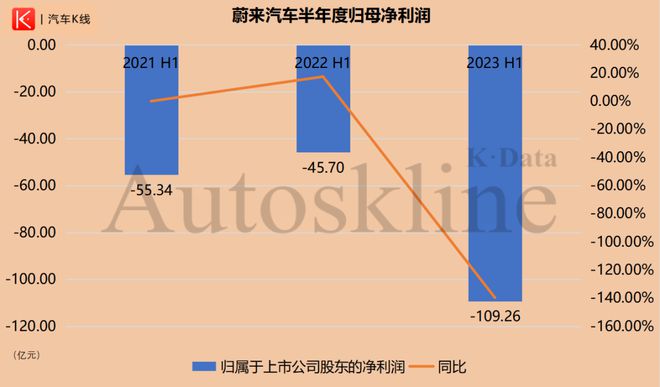

NIO is showing a trend of expanding losses. In the second quarter, NIO’s net loss was 6.056 billion yuan, an increase of 119.6% year-on-year and 27.8% month-on-month. In the first half of this year, NIO’s net loss has exceeded 10.90 billion yuan, an increase of 139.07% year-on-year. The degree of loss is about two Xiaopeng and close to five zero runs.

No matter whether it is a single quarter or the entire first half of the year, NIO’s net profit attributable to the parent has hit a record low for the same period in history.

When everyone first "debuted" at the same time, NIO was once the "big brother" of the new car-making force in the limelight, but now its profitability is directly at the bottom of the "Wei Xiaoli" three, and it is even inferior to the zero-run car that came from behind.

Where did NIO’s money "lose"?

2 Continuing the "vicious circle" for the first quarter?

In fact, the previously mentioned problem of falling auto sales due to higher deliveries of low-priced cars did not occur only in the second quarter. According to the first quarter performance report of 2023, NIO’s auto sales revenue in the first quarter was 9.225 billion yuan, down 0.2% and 37.5% respectively from Quarter 1 in 2022 and the fourth quarter of 2022.

In this regard, NIO said that the lower average selling price was mainly due to the higher proportion of ET5 and 75kWh standard battery pack deliveries, which was partially offset by the increase in deliveries.

This is the same as the explanation given by NIO in the 2023 second quarter report mentioned earlier.

It can be seen through public information that the price of ET5 75kWh is about 298,000 yuan, while the price of the 100kWh version is about 356,000 yuan, and the price difference between the two is about 60,000 yuan. Although the first and second quarter results did not disclose the specific model sales ratio, the increase in the proportion of low-priced car deliveries brought more than just the decline in car sales.

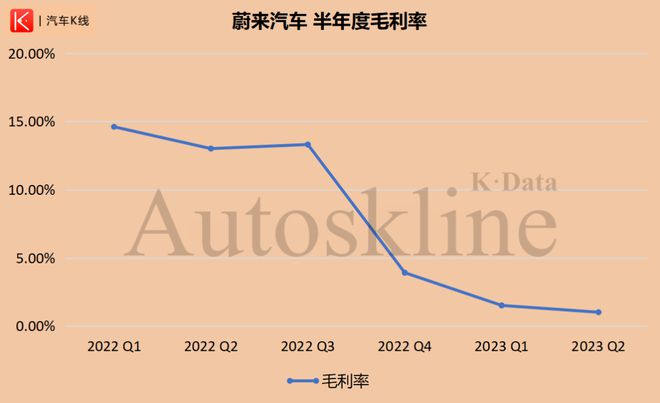

In the face of the Hong Kong stock market that values delivery volume, NIO sold a large number of low-priced and low-battery models in the first quarter, resulting in gross profit being swallowed up, which is similar to "drinking poison to quench thirst". However, in the second quarter, in addition to the above reasons, the sales of used cars with lower gross margins also increased.

As a result, NIO’s overall gross profit margin fell from 1.5% in the first quarter to 1% in the second quarter, and in 2022, its gross profit margin in the first and second quarters can still be maintained at 14.6% and 13%, which shows that the "side effect" of low-priced models is really obvious.

What needs to be added is that the gross margin of the NIO business alone actually increased by 1.1 percentage points in the second quarter of 2023 due to the decrease in the promotion of the previous generation ES8, ES6 and EC6 models. However, compared with the same period in 2022, the gross margin decreased by more than 10 percentage points due to the previously mentioned product portfolio changes.

It is worth noting that while NIO’s revenue decreased, losses expanded, and overall gross profit margin decreased, investment did not contract. Data show that NIO’s sales, general and administrative expenses in the second quarter of this year were 2.857 billion yuan, which was higher than Li Auto and XPeng Motors 550 million yuan and 1.30 billion yuan respectively.

On the other hand, NIO’s operating expenses are also rising, of which R & D expenses reached 3.345 billion yuan in the second quarter, an increase of 55.6% year-on-year, mainly due to the increase in R & D personnel costs, equity incentive expenses, and new product and new technology design and development.

The poor performance has made the NIO dual shares equally "unfavorable" in the capital markets. In the August list of auto stocks counted by Auto K Line, both NIO dual shares fell from the "red list" in July to the "green list" in August, with a decline of 32.88% (US stocks) and 27.93% (Hong Kong stocks), ranking second and fifth from the bottom of the August total list respectively.

Although the performance and stock price are not satisfactory, NIO is still optimistic. In the third quarter of 2023, NIO expects to deliver 55,000-57,000 new cars, an increase of 74% -80.3% compared with the same quarter in 2022; the revenue guidance is 18.898 billion yuan-19.50 billion yuan, an increase of 45.3% -50.1% year-on-year. Comparing the year-on-year growth rate of deliveries and revenue, it is not difficult to find that in the third quarter, NIO may still be difficult to get out of the whirlpool of gross margin "autophagy".

3 Views ofAutosKline

Looking back at the first half of the year, NIO experienced a period of downturn.

Perhaps the release of the mid-size SUV EC6 on September 15 can help NIO start from "selling more cars" and achieve more profitability.

The victory and defeat of the first half of the year has become history, and a new round of battle between the three Wei Xiaoli families has begun. Li Bin, who has always believed in long-termism, when can NIO climb out of the vortex of "autophagy" of gross profit margins?

The text is original by [Car K Line], some pictures are sourced from the Internet, and the copyright belongs to the original author. The article of this number may not be reproduced without authorization, and violators will be investigated. At the same time, the content of the article does not constitute investment advice to anyone. The stock market is risky, and investment needs to be cautious.

关于作者