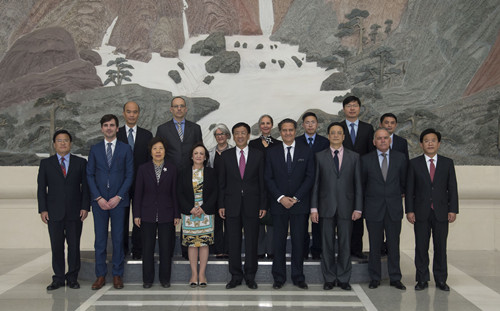

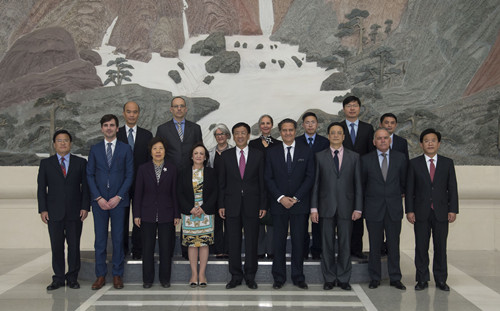

Cao Jianming meets Portuguese Attorney General Vidal.

On the afternoon of April 21st, the Supreme People’s Procuratorate Attorney General Cao Jianming met with Portuguese Attorney General Vidal and his party. [detailed]

Cao Jianming: Deeply and solidly carry out the study and education of "two studies and one work"

On the morning of April 20th, the Supreme People’s Procuratorate held a meeting of all party member cadres to mobilize and deploy the "two studies and one work" study and education. The Supreme People’s Procuratorate Party Secretary and Procurator-General Cao Jianming made a mobilization speech. He stressed that Party organizations at all levels of the Supreme Procuratorate and all party member cadres should conscientiously study and implement the spirit of the important instructions of the Supreme Leader General Secretary, unify their thoughts and actions with the deployment requirements of the CPC Central Committee, carry out in-depth and solid study and education on "two studies and one work", focus on strengthening the ideological and political construction of procuratorial organs, and implement comprehensive and strict inspection in every party branch of the organ. [detailed]

Cao Jianming meets delegation of Brazilian Prosecutors Association.

On April 20th, Cao Jianming, Attorney-General of the Supreme People’s Procuratorate, met with a delegation of Brazilian Prosecutors Association in Beijing. [detailed]

Cao Jianming: Give full play to the deterrent effect of inspection and supervision within the system.

On April 19th, the national inspection work conference of procuratorial organs and the mobilization and deployment meeting of the first round of inspection work in the Supreme People’s Procuratorate in 2016 were held in Beijing. The meeting conveyed the spirit of the important speech of the Supreme Leader General Secretary and Comrade Wang Qishan on inspection work. Cao Jianming, Party Secretary and Procurator-General of the Supreme People’s Procuratorate, attended the meeting and made an important speech. [detailed]

Cao Jianming: Insist on anti-corruption in accordance with the law and better perform the duty of investigating and preventing duty crimes.

From April 14th to 15th, the National Conference on the Investigation and Prevention of Duty Crimes by Procuratorial Organs was held in Beijing. Before the meeting, Cao Jianming, Party Secretary and Procurator-General of the Supreme People’s Procuratorate, put forward requirements for strengthening the investigation and prevention of duty crimes. Qiu Xueqiang, Deputy Secretary of the Supreme Inspection Party Group and Deputy Procurator-General, attended the meeting and delivered a speech. Cao Jianming demanded that procuratorial organs at all levels should bear in mind their political and legal responsibilities to participate in the anti-corruption struggle, conscientiously implement the central government’s decision-making arrangements, adhere to anti-corruption according to law and use anti-corruption, better perform their duties of investigating and preventing duty crimes, and make greater contributions to further promoting the building of a clean and honest party style and the anti-corruption struggle. [detailed]

The Supreme Procuratorate issued the implementation plan of "two studies and one doing" study and education.

Recently, the the Supreme People’s Procuratorate authorities issued the "Implementation Plan of" Two Learning and One Doing "study and education, which made arrangements for the Supreme Procuratorate to carry out the" two learning and one doing "study and education from six aspects: general requirements, basic principles, main contents, problem solving, promotion measures and organization and leadership. [detailed]

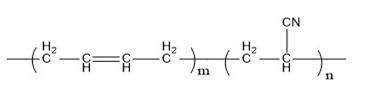

The Supreme People’s Procuratorate formulated and issued "Basic Standards for Post Abilities of Procuratorial Organs" (for Trial Implementation)

Recently, the Supreme People’s Procuratorate has formulated and issued the Basic Standards of Post Abilities of Procuratorial Organs (for Trial Implementation), which means that whether prosecutors can be competent for a certain procuratorial post in the future will be measured and judged by corresponding basic standards of post aptitude. [Detail] [Interpretation] [Illustration]

最高检:学习贯彻习总书记对开展“两学一做”学习教育重要指示

4月18日,最高人民检察院党组书记、检察长曹建明主持召开最高检党组会议,认真学习贯彻最高领袖总书记对在全党开展“两学一做”学习教育的重要指示和“两学一做”学习教育工作座谈会精神,审议通过了《最高人民检察院机关“两学一做”学习教育实施方案》和《关于在全国检察机关全体党员中开展“两学一做”学习教育的通知》。[详细]

最高检举行“十三五”规划纲要主要精神专题辅导报告会

4月18日,最高人民检察院举行党组中心组(扩大)学习专题辅导报告会,邀请国务院发展研究中心副主任王一鸣就“十三五”规划纲要主要精神作专题辅导报告。[详细]

最高检:统一法律适用标准严查贪污贿赂犯罪案件

4月18日,最高人民检察院印发通知,对检察机关贯彻执行《最高人民法院、最高人民检察院关于办理贪污贿赂刑事案件适用法律若干问题的解释》,进一步加强和规范检察机关查办贪污贿赂犯罪工作提出要求。[详细][“两高”发贪贿刑案司法解释][全文][八问“两高”办理贪腐案件新司法解释][检察机关近三年查办贪贿犯罪大要案逐年增加]

胡泽君:议案建议提案办理要解决问题取得实效

4月21日,最高人民检察院召开全国人大代表议案建议和全国政协提案交办会,225件议案建议提案交由20个内设机构和直属事业单位办理。最高检党组副书记、常务副检察长胡泽君强调,扎实做好2016年最高检议案、建议和提案办理工作,确保办理工作解决问题、取得实效。[详细]

邱学强:以习总书记反腐思想为引领 全面担当职务犯罪侦防工作使命

4月14日至15日,全国检察机关职务犯罪侦查预防工作会议在京召开。最高人民检察院党组副书记、副检察长邱学强在会上讲话强调,各级检察机关要以最高领袖总书记反腐败战略思想为引领,以全面担当侦查预防工作多元使命为主线,聚焦功能多元、方式多元、效果多元,大力推进队伍专业化、执法规范化、管理科学化、保障现代化,坚定不移走中国特色职务犯罪侦防之路,为党风廉政建设和经济社会发展提供坚强有力的法治保障。[详细]

Li Rulin: Criminal execution procuratorial work should dare to supervise, be good at supervision and supervision in place.

On the morning of April 16th, Li Rulin, a member of the Supreme People’s Procuratorate Party Group and Deputy Procurator-General, attended the graduation ceremony of "National Procuratorial Organs’ Symposium on Criminal Execution and Procuratorial Work and Key Business Training Course" held in Xinxiang City, Henan Province. In his speech, Li Rulin congratulated the successful conclusion of this training course and paid high tribute to the units and individuals commended at the meeting. [detailed]

Xu Weiguo: Highlighting political inspections and adhering to problem orientation

Xu Weiguo, member of the Party Group of the Supreme People’s Procuratorate and head of the discipline inspection team of the Central Commission for Discipline Inspection in the Supreme Inspection, stressed at the summary of the National Conference on Inspection Work of Procuratorates and the mobilization and deployment meeting of the first round of inspection work in 2016 on April 19 that in carrying out inspection work, procuratorial organs must carry out the spirit of the series of important speeches by the Supreme Leader, highlight political inspections, adhere to the problem orientation, and give full play to the role of inspection work as a weapon in comprehensively and strictly administering the party and the inspection. [detailed]

Wang Shaofeng: Promoting the construction of grass-roots procuratorates to a new level and opening up a new situation with innovative spirit

Recently, Wang Shaofeng, a member of the Party Group of the Supreme People’s Procuratorate and director of the Political Department, and his party went to Jiangxi to make a special investigation on the outline of the development plan for procuratorial work during the Thirteenth Five-Year Plan period, and held symposiums in Jiangxi Provincial Procuratorate and Yushui District Procuratorate of Xinyu City successively to listen to opinions and suggestions on the revision of the Organic Law of People’s Procuratorate, and to visit and sympathize with grassroots procuratorial police officers. [detailed]

Zhang Deli: Promoting the reform of responsibility system around the goal of improving judicial public trust

On April 15th, an investigation and exchange meeting on the power list of judicial responsibility system reform of some provincial procuratorates was held in Hefei, Anhui Province. Zhang Deli, a full-time member of the Supreme People’s Procuratorate Procuratorate, attended the meeting and stressed that we should firmly grasp the judicial responsibility system as the "bull’s nose" of judicial reform, clarify responsibilities and determine responsibilities through scientific and reasonable authorization, and achieve the goal of maintaining judicial justice and improving judicial credibility by improving procuratorial management system and procuratorial power operation mechanism. [detailed]

Lu Xi: constantly improving the level of ability and creating a new situation in investigation and prevention work

On April 14th, Lu Xi, a full-time member of the Supreme People’s Procuratorate Procuratorate and director of the General Administration of Anti-Corruption and Bribery, made a speech at the national conference on the investigation and prevention of duty crimes by procuratorial organs, demanding that procuratorial organs at all levels should constantly improve their ability in the investigation and prevention of duty crimes and create a new situation in the investigation and prevention. [detailed]

National inspection work conference of procuratorial organs: faithfully performing their duties, daring to take on the mission and not paying great trust

On April 19th, the delegates attending the National Conference on Inspection Work of Procuratorial Organs and the mobilization and deployment meeting of the first round of inspection work of the Supreme People’s Procuratorate in 2016 said during the group study and discussion that they should seriously study, understand and implement the spirit of this conference, strengthen their own construction with higher standards and stricter requirements, faithfully perform their duties, dare to take responsibility, live up to their mission, and do not bear the great trust, and successfully complete the inspection tasks assigned by the organization. [detailed]

In 2015, the procuratorial organs arrested 2,615 cases involving IPR infringement.

On April 19th, the State Council Information Office held a press conference to inform the media about the development of intellectual property rights in China in 2015. The reporter learned that in 2015, the national procuratorial organs performed various procuratorial functions according to law and severely cracked down on intellectual property infringement crimes. A total of 2,615 cases involving 4,445 people were arrested and 4,484 cases involving 8,025 people were prosecuted. [detailed]

Procuratorial organs first carried out forensic anthropology training.

On April 18th, the first training class of forensic anthropology for the national procuratorate was held in Kaifeng, Henan Province, mainly to cultivate the participants’ cognitive and practical ability in forensic anthropology. [detailed]

A series of reports on the construction of procuratorial team since the 18th National Congress: building a high-quality and excellent team strictly and practically.

Since the 18th National Congress of the Communist Party of China, procuratorial organs throughout the country have thoroughly implemented the central decision-making arrangements, firmly grasped the "five excellent" requirements, and strived to build a procuratorial team with firm beliefs, justice for the people, courage to take responsibility, and integrity. [detailed]

The Procuratorate of Inner Mongolia Autonomous Region decided to file an investigation on Bao Shengrong according to law.

On April 19, 2016, the People’s Procuratorate of Inner Mongolia Autonomous Region decided, after examination, to file a case for investigation on Bao Shengrong (deputy department level), a member of the party group and deputy director of the Standing Committee of Ordos Municipal People’s Congress, and take compulsory measures. The investigation of the case is in progress. [detailed]

Hubei procuratorate decided to arrest Li Gongming according to law.

A few days ago, the People’s Procuratorate of Wuhan City, Hubei Province decided to arrest Li Gongming (deputy bureau level), the former vice chairman of the Jiang ‘an District CPPCC in Wuhan, on suspicion of abuse of power and accepting bribes. The investigation of the case is in progress. [detailed]

Shandong procuratorate prosecuted Huang Jinzhong for alleged corruption and bribery according to law.

Huang Jinzhong, former deputy mayor of Dezhou Municipal People’s Government of Shandong Province (deputy department level), was suspected of corruption and bribery. The Shandong Provincial People’s Procuratorate appointed the Jinan Municipal People’s Procuratorate to file a case for investigation. After the investigation, the Anti-Corruption and Bribery Bureau of Jinan Municipal People’s Procuratorate transferred it to the second public prosecution office of the hospital for review and prosecution. A few days ago, the Jinan Municipal People’s Procuratorate has filed a public prosecution with the Jinan Intermediate People’s Court. [detailed]

Shandong procuratorate prosecuted Tian Zhenyu’s suspected bribery case according to law.

Tian Zhenyu (director level), former first deputy director and party secretary of the Standing Committee of Dongying Municipal People’s Congress in Shandong Province, was suspected of accepting bribes. The People’s Procuratorate of Shandong Province appointed the People’s Procuratorate of Jining City to file a case for jurisdiction. After the investigation by the Anti-Corruption Bureau of Jining City People’s Procuratorate, it was transferred to the Second Public Prosecution Office of the hospital for review and prosecution. A few days ago, the People’s Procuratorate of Jining City filed a public prosecution with the Intermediate People’s Court of Jining City. [detailed]

The procuratorate of Inner Mongolia prosecuted Tang Aijun’s suspected bribery case according to law.

The case of Tang Aijun (director level), the former deputy secretary of the municipal party committee and mayor of Hohhot, which was investigated by the People’s Procuratorate of Inner Mongolia Autonomous Region, was under the jurisdiction of the People’s Procuratorate of Inner Mongolia Autonomous Region. On April 19, 2016, the People’s Procuratorate of Ordos City filed a public prosecution with the Intermediate People’s Court of Ordos City. [detailed]

Guangdong procuratorate prosecuted Wang Hong for allegedly taking bribes and using influence to take bribes according to law.

A few days ago, Wang Hong (deputy department level), the former president of Guangdong Architectural Design and Research Institute, was suspected of taking bribes and using influence to take bribes. After being assigned by the Guangdong Provincial People’s Procuratorate, the Shenzhen Municipal People’s Procuratorate of Guangdong Province filed a public prosecution with the Shenzhen Intermediate People’s Court according to law. [detailed]

The Henan procuratorate prosecuted Guo Fajie’s suspected bribery case according to law.

A few days ago, Guo Fajie (deputy department level), former member of the Standing Committee of Anyang Municipal Committee of the Communist Party of China and former secretary of the Political and Legal Committee of Anyang City, was suspected of accepting bribes. The People’s Procuratorate of Zhoukou City, Henan Province has filed a public prosecution with the Intermediate People’s Court of Zhoukou City, Henan Province according to law. [detailed]

Investigation on the involvement of Jiangxi procuratorate in cadmium pollution in Fairy Lake

After the cadmium pollution incident in Fairy Lake, Xinyu City, Jiangxi Province, which attracted much attention, the third-level procuratorial organs in Jiangxi Province immediately took action, intervened in the investigation of the pollution incident, assisted and cooperated with environmental protection, public security and other departments, closely followed and supervised, and guided evidence collection. [detailed]

Shaanxi: research to ensure and promote the development of non-public economy

Recently, the Shaanxi Provincial Procuratorate and the Provincial Federation of Industry and Commerce jointly held a symposium on safeguarding the development of the non-public economy. Hu Taiping, Procurator-General of Shaanxi Provincial Procuratorate, Feng Yueju, Chairman of the Federation of Industry and Commerce of Shaanxi Province, NPC deputies, CPPCC members and entrepreneurs from the industrial and commercial circles gathered together to discuss how procuratorial organs can safeguard and promote the healthy development of the non-public economy in accordance with the law under the new situation. [detailed]

Hunan: Establish a system of discipline interpretation and reasoning for disciplinary review documents.

Recently, Hunan Provincial Procuratorate issued "Guiding Opinions on Explaining Discipline and Reasoning of Disciplinary Review Documents", requiring the discipline inspection and supervision institutions of the procuratorial organs in this province to standardize the contents of disciplinary review documents and establish a system of explaining discipline and reasoning of disciplinary review documents, which shocked the offenders and educated party member. [detailed]

Qinghai special investigation and prevention of duty crimes in poverty alleviation field

Recently, a special work conference on centralized rectification and strengthening the prevention of duty crimes in the field of poverty alleviation by procuratorial organs in Qinghai Province was held in Xining. Men Yanbai, the chief procurator of the provincial procuratorate, stressed that the procuratorial organs in the province should closely focus on the decision-making and deployment of poverty alleviation in Qinghai Province, further strengthen legal supervision, seriously investigate and actively prevent job-related crimes in the field of poverty alleviation, and carry out in-depth special work to ensure that poverty alleviation funds are safely in place, used in place and played their role. [detailed]

Xinjiang strives to improve the quality of supervision of the people’s bank of China

The Procuratorate of Xinjiang Uygur Autonomous Region recently held a symposium on civil administrative litigation supervision of procuratorial organs in Xinjiang. The meeting demanded that procuratorial organs in Xinjiang should focus on improving the quality of civil administrative litigation supervision, pay close attention to the key links that affect the quality of cases, carry out regular case quality evaluation, and strengthen the guidance for handling cases. Efforts should be made to promote mechanism innovation, establish horizontal internal cooperation mechanism, strengthen external coordination and cooperation mechanism, and build a diversified supervision pattern. [detailed]

Inner Mongolia deploys "two studies and one doing" study and education

On the afternoon of April 15th, the Procuratorate of Inner Mongolia Autonomous Region held a video conference of the third-level hospital to deploy the study and education of "two studies and one doing". Ma Yongsheng, the chief procurator of the hospital, pointed out that the activity of "benchmarking Si Qi to be a Pan Zhirong-style Communist party member" should be regarded as an important carrier and optional action of "two studies and one doing" study and education, and Comrade Pan Zhirong should be taken as an example to achieve the combination of "one thought, three investigations and five investigations" to find gaps and make up for deficiencies. [detailed]

Jiangxi special supervision activities care for green mountains and green waters

Since the Jiangxi Provincial Procuratorate deployed the special supervision activity of "strengthening ecological inspection and serving the green rise" in August 2015, the procuratorial organs of the province have comprehensively used procuratorial suggestions, supporting prosecution and other supervision means around key areas such as land and water resources to care for the mountains, rivers and clean air in Jiangxi. [detailed]

Fujian: Cultivating talents by selecting talents and focusing on cultivating high-level procuratorial talents.

Cultivating talents, selecting talents and using talents are important measures for Fujian Provincial Procuratorate to implement the strategy of compulsory inspection of talents. The Medium-and Long-Term Plan for the Construction of Procuratorial Talents in Fujian Province (2010-2020) formulated by the Institute clearly stipulates the main tasks, objectives, requirements and personnel training, selection and appointment mechanism. By 2020, the procuratorial organs in this province will train and select 12 national procuratorial experts, 60 provincial-level professional experts, 300 top professionals and 1,000 excellent case-handling experts. [detailed]

Jiangsu actively explores service to ensure the innovative development of non-public economy.

Under the new normal of economic development, the procuratorial organs in Jiangsu Province are constantly emancipating their minds, changing their concepts, and actively exploring new ideas and methods to ensure the development of non-public economy. [detailed]

Chongqing set up a leading group for the special work of rectifying duty crimes in the field of poverty alleviation

Recently, the Chongqing Municipal Procuratorate set up a leading group to focus on rectifying and strengthening the special work of preventing duty crimes in the field of poverty alleviation, with the heads of relevant departments of the Municipal Procuratorate such as duty investigation, prevention, investigation and supervision, public prosecution and publicity as members, and earnestly strengthened the organization and leadership of the special work. [detailed]

Shandong builds a high-quality bailiff training base.

Recently, Linyi Branch of Shandong Prosecutor Training College was officially approved by the Supreme People’s Procuratorate as the "National Judicial Police Training Base for Procuratorial Organs". It is understood that under the guidance of the Shandong Provincial Procuratorate, Linyi Branch will further improve the teaching facilities, enrich the teaching staff, strengthen the teaching management, innovate the training mode, strengthen the standardization of the judicial police training base, and strive to build a first-class high-quality judicial police talent training base. [detailed]

Hubei trained more than 800 prosecutors in rotation.

On April 14th, the Hubei Provincial Procuratorate completed the intensive training for more than 800 members of the leadership team and prosecutors in provincial hospitals at the city and county levels in the province, and the rotation training of prosecutors in the local area by the city and county procuratorial branches will soon be fully rolled out. [detailed]

Guangdong sets up anti-corruption high-voltage lines for precision poverty alleviation

On April 12, the Guangdong Provincial Procuratorate and the Provincial Poverty Alleviation Office jointly held a special work conference on centralized rectification and strengthening the prevention of duty crimes in the field of poverty alleviation, and deployed the special work of centralized rectification and strengthening the prevention of duty crimes in the field of poverty alleviation in the province. [detailed]

Beijing establishes research center for procuratorial reform and development.

On April 14th, the Research Center for Procuratorial Reform and Development of Beijing Municipal Procuratorate was established. The ceremony was attended by Jing Dali, Procurator-General of Beijing Municipal Procuratorate, many experts and scholars from China legal circles and relevant leaders of the city’s procuratorial system. [detailed]

Jiangxi: data "reduction" helps to handle cases

Jiangxi Provincial Procuratorate strives to promote the deep integration of electronic data technology and judicial case handling. Through the extraction, fixation, inspection and appraisal of electronic data, it has installed a sensitive "electronic eye" for case breakthrough and evidence review. [detailed]

Twenty measures in Guizhou to serve the non-public economy

The Guizhou Provincial Procuratorate has recently formulated and promulgated the Twenty Measures of the People’s Procuratorate of Guizhou Province on Giving Full Play to the Procuratorial Function to Guarantee and Promote the Healthy Development of the Non-public Economy, so as to guarantee and promote the healthy development of the non-public economy according to law. [detailed]