Recently, at the 16th China Automotive Blue Book Forum, Autonavi Maps officially released AutoSDK 750 for the automotive industry, launching a number of function updates including new energy navigation, multi-scenario lane-level safety warning, lane-level navigation 5.0, co-pilot screen weekend travel assistant, driver interconnection seamless connection experience, scene engine fast departure, etc.

In recent years, China’s new energy vehicle market penetration rate has been rising, as of March 2024 has reached 48.2%, and in 2023 this data is only 31.6%.

This growth rate indicates that in the near future, new energy vehicles will become the dominant force in the Chinese market. At the same time, the application of artificial intelligence, big data, cloud computing and other technologies has also brought unprecedented innovation and change to the automotive industry.

Jiang Rui, vice president of Autonavi Maps, judged that the future mainstream car is a combination of new energy and intelligence, and the core R & D strength of the car factory will be concentrated in these two parts. At the same time, no matter what the price of travel, the driver and passenger experience cannot escape the three keywords of "safety, efficiency and comfort".

"Autonavi Maps will also provide users with valuable mobility products around these three keywords," Jiang Rui said.

Intelligent and new energy face challenges

According to the data, as of May 2023, the member units of the China Charging Alliance have reported a total of 2.084 million public charging piles, including 877,000 DC charging piles and 1.207 million AC charging piles. From June 2022 to May 2023, the monthly average of new public charging piles is about 55,000.

Although a large number of charging piles have been built, the current total amount of charging piles cannot fully meet the charging needs of electric vehicles. At the same time, factors such as uneven distribution of charging piles and uneven quality of charging piles have caused the tram to be easy to use and difficult to charge.

When planning the charging route of electric vehicles, taking into account various factors such as different car companies’ different definitions of charging preferences, users’ preferences for charging piles, and the inconvenience of charging piles located underground will lead to "charging anxiety" when users go out.

With the continuous improvement of the human-vehicle interaction experience, the integration of various information such as navigation, control, and information display into a highly visually impactful screen has become the prelude to the transformation of smart cars, and the multi-screen interconnection design has also become a new generation of smart cars.

However, the exclusive screen services corresponding to the main driver’s screen, co-pilot’s screen, and rear cabin screen, because of their different functions, how to ensure that the navigation information before the screen flows, rather than exists in isolation. This is affected by many factors such as safety, physical materials, and performance.

At the same time, due to inconsistent strategies and technologies, users experience differences when using mobile phones and cars to navigate. Intelligence is inseparable from the discussion of "handcar interconnection". In the navigation scenario, how to create intelligent experiences at different end points of mobile phones and cars is also a challenge currently facing.

In addition, on the one hand, China’s transportation game is extremely complex, not only reflected in the scale and diversity of transportation networks, but also in policy formulation, planning implementation, operation management and other aspects. On the other hand, as of the first half of 2023, China’s new passenger car sales with combined driving auxiliary features have accounted for 42.4%.

Complex traffic information and a large number of auxiliary driving vehicles also put forward further requirements for maps, mainly reflected in map freshness, complex intersection recognition, dynamic variable processing, recognition training generalization of traffic infrastructure, and understanding of traffic rules.

This also puts forward further requirements for the safety early warning capability in the travel ecosystem. At present, the Autonavi map app has realized the lane-level early warning function of the top ten scenarios, providing users with real-time early warning of driving risks in an all-round and over-the-horizon manner, making travel safer.

Finally, although all mid-to-high-end models are currently equipped with lane-level navigation functions as standard, there is still room for improvement in terms of effectiveness, performance, and efficiency.

AutoSDK 750 + lane-level navigation 5.0 + HQLive map services provide comprehensive solutions to help automakers create user experiences that exceed expectations

Based on this background, Autonavi Maps officially released AutoSDK 750 for the automotive industry, providing users with better services and experiences together with automakers.

Based on the rich and prepared charging pile data, it brings users more personalized type screening and search recommendation functions. Support checking "alternative charging stations", user setting pile preference/block charging piles, alternative routes, and can provide a consistent experience of handcar interconnection.

Starting with the short-distance tour scene of a family trip, the co-pilot screen will display the full list of the journey and highlight the unique geographical location information during the journey, allowing the co-pilot to be a good driver and helper.

It can be connected on foot. When the user plans to go to the shopping mall store, they can navigate to the parking lot, walk to the store in the shopping mall, automatically connect to the AutoNavi Map mobile APP, and navigate the return on foot through the recorded parking location.

Non-inductive interconnection, supports more effective mutual discovery between the car and the Autonavi mobile APP, prompts the user to scan and log in from the mobile phone side to realize connection, and can realize functions such as mobile phone viewing POI and automatic navigation initiated by the car after planning the route.

Based on massive travel data, anticipate the user’s travel purpose, prompt the user on the car map, and directly click on the navigation to start quickly.

In addition, last year, Autonavi Maps released HQ Live MAP, which integrates the advantages of HD MAP and SD MAP, and through self-developed crowdsource equipment, based on the visual crowdsource acquisition technology under the compliance platform, it is widely deployed to a large number of logistics vehicles, industry vehicles, dispatching vehicles, etc., to achieve a significant improvement in the complete process from discovery, collection, production to release, and to create a "living map" with multiple partners.

Jiang Rui said that the current HQ Live MAP is constantly improving its freshness, not only expressing complex intersection scenes with sufficient detail, but also providing a large amount of real-time and accurate dynamic data such as lane-level construction and accidents, which can not only provide over-the-horizon warning when driving, but also effectively improve the safety of advanced driver assistance systems.

At present, Autonavi has partnered with Ideal to update the dynamic construction information function, which will alert the driver earlier when the assisted driving is turned on.

Jiang Rui said that we clearly know that Autonavi is not enough to develop a navigation that exceeds users’ expectations in the car. We are very grateful to the customer’s Product R & D test team, without whom Autonavi would not have been successful in the automotive field. We also hope to use our modest power to help them develop a product that exceeds expectations more efficiently through knowledge and tool system.

At present, the Autonavi Automotive Open Service website has provided comprehensive product, design, development and testing guidelines for certified users for customer reference, and will increase the ability of models in the future. Launched a new development intelligence kit, continuously reducing granularity to provide engineers with effective code, and will continue to improve design tools, power builders and testing tools, dedicated to providing customers with a tool chain that can reduce costs and increase efficiency.

Jiang Rui said that we will continue to work on the road of "good development" and "good development", so that car companies can develop products that exceed user expectations more efficiently and cost-effectively. Dozens of car companies have chosen AutoSDK750 and lane-level 5.0 version for mass production or OTA, and we are also working non-stop on the development of the next generation version and the planning of the next generation version.

As a leading provider of digital map content, navigation and location-based service solutions in China, "making a map" has been Autonavi’s original intention since its establishment in 2002. Over the past two decades, it has accumulated strong technologies, products and ecological capabilities, and is in a leading position in the industry from the perspective of "guiding people" and "guiding cars". As of now, Autonavi has more than 40 car company partners and has served hundreds of thousands of cars in mass production.

Jiang Rui said that China’s automobile industry is facing upgrading changes, and opportunities and challenges coexist on the road to new energy and intelligence. Autonavi Map will work with all partners to contribute to the upgrading of China’s automobile industry.

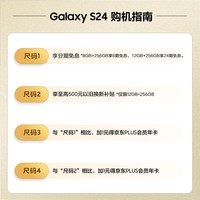

![[Slow hands] Samsung Galaxy S24 5G mobile phone is on the shelves, the original price is 5,500 yuan, and it only costs 4,900 yuan to get it.](http://www.searchtmr.com/wp-content/uploads/2022/07/O5qtGsE5.jpg)