In-depth analysis of the new share Xiaomi model: efficiency wins, cost performance is king, and an intelligent life ecosystem is built. March 1, 2018, 12:15:40.

This article comes from WeChat WeChat official account’s "Guangfa Business Retail". The authors are Hong Tao, Ye Qun and Lin Weiqiang, the business retail group of Guangfa Securities Development Research Center. The original title is "In-depth Analysis of Xiaomi Model: Cost-effectiveness is king, efficiency wins, and the ecological circle of national intelligent life is built-the beginning of the research series of new retail model..

There are a lot of researches and debates on the "new retail" model in the market. We aim to explore the innovation of each model and its reference significance for industry reform through in-depth combing and thinking of typical companies. As the beginning of the series of reports, we first pay attention to Xiaomi. Compared with Ali and Tencent’s (00700) new retail layout of "empowerment" and "buy buy Buy" and online and offline retail companies "standing in line", Xiaomi’s "single-handedness" new retail is more like a "clean stream". we thinkThe rise of Xiaomi’s "cost-effective explosion", "Xiaomi House" and "Xiaomi ecological chain" reflects the rise of "manufacturing retail" and the huge excavation space of offline retail channel efficiency.

In the domestic PC Internet era, Baidu, Alibaba and Tencent are known as the "BAT" giants, which respectively control the three major Internet portals of search, e-commerce and social networking. After the rise of mobile Internet, the market always expects the rise of emerging Internet companies to challenge the Big Three. Especially in recent years, Baidu’s layout in the mobile Internet market is slightly backward, and its market value has been widened by Alibaba and Tencent. Who will succeed Baidu as the third Internet force outside AT has become the focus of discussion.

The growth experience of Xiaomi Company is legendary:Xiaomi, founded in 2010, started from scratch in just four years, and reached the top of the first smart phone brand in China in 2014, becoming the lucky one to take off with the mobile Internet. Long before the phrase "Are you ok" spread all over the Internet, with the outbreak of Xiaomi, Xiaomi founder Lei Jun’s theories of "Pig on the Wind", "Focus, Extreme, Word of Mouth, Fast" have been regarded as the standard of Internet thinking. After the low tide in 2016, Xiaomi miraculously broke out on the three fronts of mobile phone, ecological chain and Xiaomi House in 2017, and the king returned, becoming the only mobile phone brand that can be successfully reversed after the sales decline. Xiaomi has experienced great ups and downs in less than eight years since its establishment. Lei Jun, who is "my brother in the society, and there are not many people and goods", has once again become the godfather of Internet entrepreneurship.

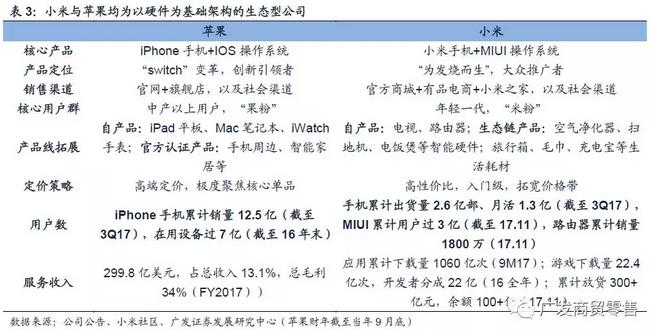

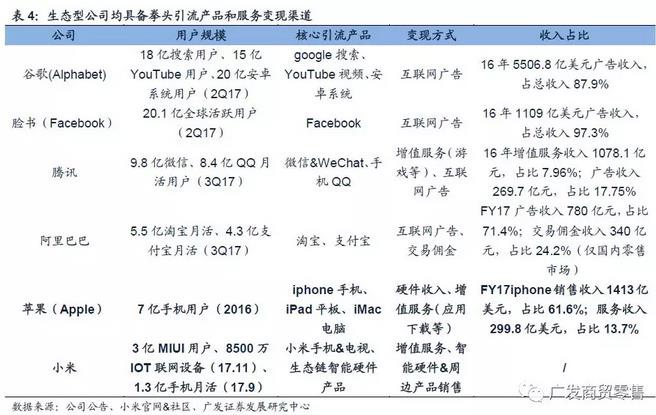

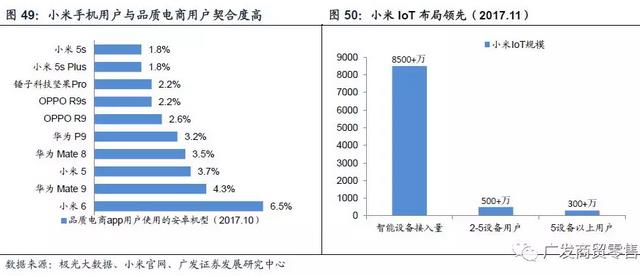

Under the Xiaomi system, the cumulative number of users of MIUI system exceeded 300 million, the cumulative shipment of mobile phones was 260 million, and the monthly users were 130 million. Another 85 million IoT networking devices were awakened through Xiaomi AI speakers. Just as Apple encircles "fruit powder" with iPhone, Xiaomi has actually encircled "rice flour" with mobile phones and eco-chain intelligent hardware products. Xiaomi, who "refuses to run a score" and never forgets the cost performance, is actually an eco-company built by Apple in hardware in strategy, while practicing the cost performance boutique strategy represented by MUJI and Costco in tactics.

Study millet,It is not only the combing and learning of this ecological giant company, but also the insight and grasp of the consumption trend of the younger generation. And just as Apple has driven the industrial chain, Xiaomi, as an eco-giant company in the future, its growth is bound to benefit the upstream and downstream companies in the industrial chain.

Based on Xiaomi’s layout in the three major areas of IoT hardware, new retail channels and Internet-Internet of Things services, and the positioning of the national science and technology life ecosystem, the future development potential of Xiaomi’s ecological user scale and product boundary is great. Xiaomi is expected to become a force to be reckoned with in the new Internet retail market in China besides Alibaba and Tencent!

Understanding Xiaomi: Apple Strategy+Good Tactics, Hardware Building Ecosphere

In April 2010, Xiaomi was formally established. In just four years, Xiaomi started from scratch. In 2014, it surpassed Samsung to become the largest smartphone brand in China, and the investment valuation in the primary market has reached 45 billion US dollars. After the low tide in 2016, in 2017, Xiaomi once again became the absolute protagonist of the hot market discussion with the popularity of Xiaomi mobile phone, Xiaomi ecological chain and Xiaomi home.

Xiaomi currently has three major business segments: intelligent hardware, new retail and Internet/Internet of Things. To understand Xiaomi, we should look at the company from two dimensions of strategy and tactics: Xiaomi is an eco-internet company strategically. Similar to Apple, they are rare eco-companies with hardware-based infrastructure in the market. In addition to the core entrance of mobile phone, Xiaomi has occupied users’ cognition with the ecological chain product matrix, and strengthened the attraction of Xiaomi brand to "rice noodles"; Tactically, Xiaomi is more practicing the cost-effective boutique strategy of MUJI and Costco. The core tactic running through Xiaomi’s product line is to pursue the ultimate cost-effective explosion, and promote consumption upgrading from two directions: popularization of high-end products and quality of mass products.

(1) Breaking through the mobile phone, entering the IoT, Xiaomi ran wild for eight years.

In April 2010, Xiaomi was formally established after receiving $41 million in angel investment. In August and December of the same year, Xiaomi successively released MIUI operating system (one of the earliest Android customization optimization systems in China) and Michao (an instant messaging App released by WeChat), which accumulated great popularity among early smartphone enthusiasts. In August 2011, Xiaomi’s first-generation mobile phone MI1 was officially released, and Xiaomi officially entered the public’s field of vision. After the low tide in 2016, in 2017, with the popularity of mobile phones, eco-chain products and Xiaomi Home, Xiaomi became the only mobile phone brand that could be successfully reversed after the sales decline. Looking back on Xiaomi’s eight-year entrepreneurial history, it can be divided into three main stages:

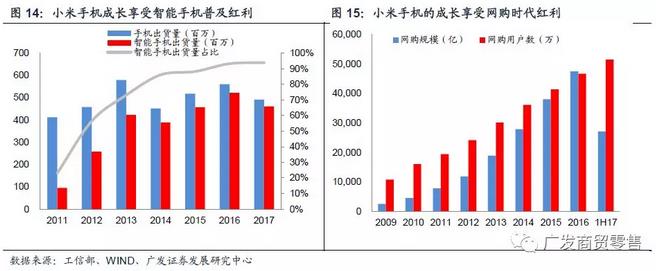

1) The outbreak period of Xiaomi mobile phone (2011-2014). In the early days, Xiaomi fully enjoyed the popularity of smart phones in China and the bonus of online shopping channels, and built two series of mobile phones, namely "Fever" and "Entry", at a price of 1,999 yuan for Xiaomi /799 yuan for Redmi. With the combination of "high-quality and low-price" of big-name high-end flagship machine configuration and domestic cottage prices, Xiaomi quickly seized the younger generation to change phones and try new markets, and became the "first smart phone" for young people.

In 2014, the annual sales of Xiaomi reached 74.3 billion yuan, the annual mobile phone shipments reached 61.12 million units, and the domestic market share climbed to 12.5%, surpassing Samsung to become the largest mobile phone brand in China. In December of the same year, Xiaomi officially announced the completion of $1.1 billion financing and introduced well-known investment institutions such as Yunfeng Fund and DST, with a post-investment valuation of $45 billion.

2) Layout period of Xiaomi ecological chain (2014-2016). After the explosive growth, the lack of control over the supply chain has become a constraint to Xiaomi’s growth. In 2015, Xiaomi’s fifth-generation flagship mobile phone (Xiaomi 5), which was originally scheduled to be released at the beginning of the third quarter, was postponed to February 2016 due to supply chain problems, resulting in Xiaomi’s lack of heavy flagship new products for the whole year, and Xiaomi’s mobile phone suffered from Waterloo. However, the bottleneck period of the mobile phone market was made up by the ecological chain layout. In 2014, Xiaomi began to invest in the ecological chain model along the three major circles of mobile phones, intelligent hardware and daily consumables to build the Xiaomi ecological circle.

From 2014 to 2016, Xiaomi invested in 77 hardware start-ups in three years, of which 30 released products. By 2016, the sales of eco-chain hardware exceeded 10 billion. In the two years when Xiaomi’s mobile phone encountered a bottleneck, it effectively maintained the popularity of Xiaomi brand and seized the IoT (Internet of Things) outlet.

3) The second take-off period of Xiaomi’s new retail (since 2017). Xiaomi’s mobile phone regained its strength after making up the shortcomings of the supply chain in 2016. The success of the MIX series of high-end machines led the trend of comprehensive screen innovation in the industry, and the overseas market represented by India replicated the success of Xiaomi’s cost-effective strategy in the domestic market; Eco-chain enterprises that have continuously invested in the layout since 2014 have also entered the product outbreak period.

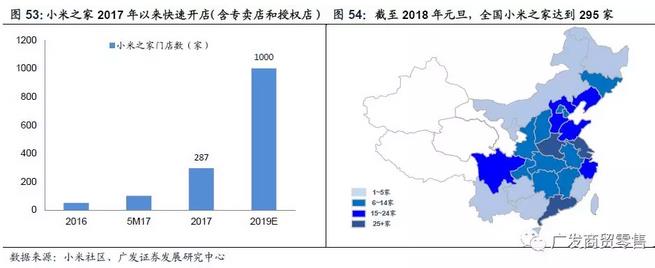

At the same time, offline Xiaomi Home has become one of the most successful offline new retail samples, and online "products" rank among the mainstream quality e-commerce. The two dimensions of product and channel broke out, which helped Xiaomi to take off for the second time: According to IDC data, in the first three quarters of 2017, Xiaomi’s mobile phone shipments reached 61.8 million units, up 71% year-on-year, and its shipments returned to the top five in the world; In October, Xiaomi completed the annual sales target of 100 billion yuan set at the beginning of the year ahead of schedule; In the whole year, the sales scale of eco-chain enterprises increased by 100% year-on-year to 20 billion, and about 235 to 287 new Xiaomi Home stores were opened.

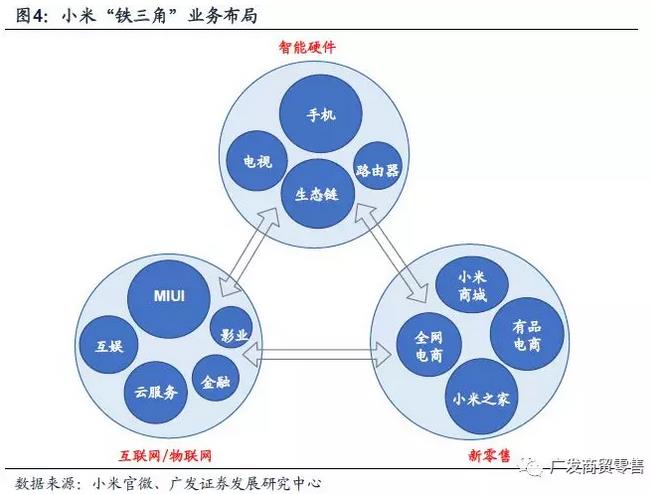

(2) Hardware+New Retail+Internet Iron Triangle to build a "rice noodle" quality life circle

Xiaomi’s current business is mainly divided into three parts: intelligent hardware (terminal products), new retail (omni-channel sales) and Internet/Internet of Things (value-added services).

1) The hardware section is Xiaomi series intelligent terminal products.. Among them, Xiaomi itself mainly produces mobile phones, televisions, routers and AI speakers (core entrance & control products). In addition, through the eco-chain investment layout, we will fully export the methodology and values of Xiaomi products, provide all-round support in design, research and development, supply chain and channels, ensure the product style is unified, and comprehensively expand the boundaries of Xiaomi eco-products along the three dimensions of mobile phone periphery, intelligent hardware and daily consumables.

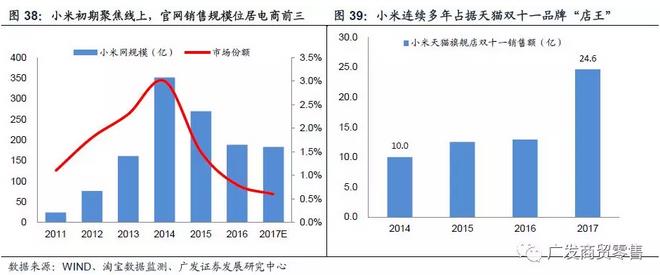

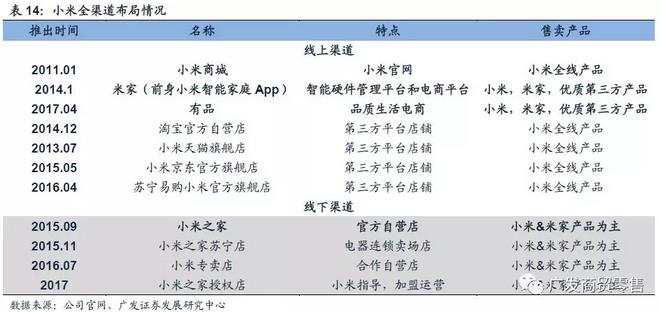

2) The new retail sector is the Xiaomi retail channel.In the early stage of its business, Xiaomi positioned itself as an Internet mobile phone brand, focusing on young people (with high Internet acceptance), and the product line under the explosion strategy was extremely limited (only 1-2 main phones were promoted each year), so it focused on online official website channels. In 2014, the sales of official website on Xiaomi Online reached 35.1 billion yuan, and the market share of e-commerce reached 3%, second only to Tmall & JD.COM among B2C e-commerce; Since 2015, with the rapid expansion of Xiaomi’s eco-chain product line, the combination of offline "Xiaomi Home" stores and online "quality" e-commerce has become a new layout of Xiaomi’s new retail channels, which is an important channel for Xiaomi’s eco-chain product experience promotion and user group expansion.

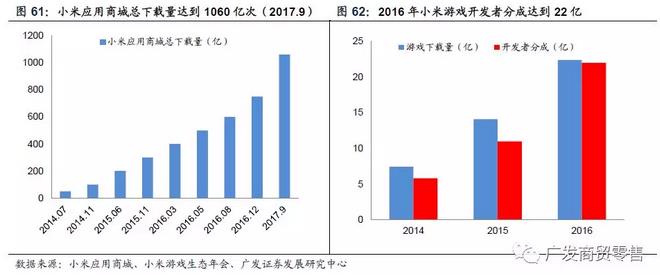

3) The Internet sector is the Xiaomi connection and value-added services sector.Around the current 300 million MIUI users, 130 million monthly users of mobile phones and 85 million users of IoT networking devices, Xiaomi Internet-Internet of Things service is first and foremost a bridge connecting Xiaomi’s intelligent terminals in series. At the same time, Xiaomi has laid out businesses such as e-commerce (goods), games (Xiaomi Entertainment), film and television (Xiaomi Film) and finance (Xiaomi Finance). With reference to the proportion of Apple service revenue in total revenue (FY17 accounts for 13.1% in total revenue and 34% in gross profit, and continues to increase), there is great room for improvement in Xiaomi’s value-added service revenue in the future, which is expected to become the most important realization channel of Xiaomi’s ecological system.

We believe that Xiaomi is similar to Apple in strategy, and it relies on smart hardware with mobile phone as the core as a fist drainage product to build a user ecosystem. But tactically, Xiaomi practices a high-cost boutique strategy similar to MUJI and Costco.

From a strategic point of view, Xiaomi, like Apple, is an eco-company with hardware as its infrastructure, and mobile phone is the core hardware entrance. The difference is that Apple is a leader in innovation, and its product positioning is high-end. The subversion of iPhone to the industry and the specificity of IOS system make it extremely attractive to users and brand premium, and the hardware itself has extremely strong profitability.

Product strategy focuses extremely on core items (excluding discontinued ipod players, and Apple’s core product lines are only iPhone, iPad tablets, Macs and iWatch watches), attracting "fruit powder" with absolute innovation of products; Xiaomi is more of a mass promoter of smart phones, and the MIUI system is also born out of the customization of Android system, so the migration of mobile phone users is much less difficult than that of Apple users. In addition to the four core imported items of self-produced mobile phones, televisions, routers and AI speakers, Xiaomi needs to occupy users’ cognition through a series of eco-chain products and strengthen the attractiveness of Xiaomi brand to "rice noodles".

From a tactical point of view, Xiaomi practices a cost-effective boutique strategy similar to Muji and Costco. The core tactic running through Xiaomi product line is to pursue the ultimate cost-effective explosion, reduce the difficulty and cost of supply chain with the strategy of selecting SKU, and let users create explosion, thus further realizing mass production and cost control; At the same time, the upstream supply chain is deeply controlled by the ecological chain incubation mode, so as to ensure the interconnection and unified style of different products, strengthen the brand awareness of Xiaomi, and promote consumption upgrading from two dimensions: the popularization of high-end products (such as smart phones, balance cars, sweepers, etc.) and the quality of mass products (such as wiring boards, suitcases, rice cookers, etc.).

From the perspective of profit model, it is estimated that the core profit sources of Xiaomi in the future mainly include three aspects:1) Select the aggregate demand of cost-effective SKU, so as to realize the combination of financial indicators of "low net interest rate, high turnover rate and high ROE" under the effect of economies of scale (similar to MUJI); 2) Service charges, that is, relying on value-added services such as games, advertisements and finance to bring service income (similar to Costco’s membership fee income and Apple’s value-added service income); 3) Tying high-margin peripheral small products (such as mobile phone shell films, etc.), as well as advertising and commission income of branded merchants with products.

Hardware Xiaomi: Cost-effective is king, Xiaomi IoT ecological entrance.

Intelligent hardware is the bottom entrance of Xiaomi’s ecology. To understand the innovation of Xiaomi model, we must first grasp Xiaomi’s product strategy. The core strategy of Xiaomi system products is to create cost-effective explosions and pursue the consumption upgrade of "high quality+reasonable price". Aggregate massive demand with high cost performance, and realize the rapid outbreak of single product scale; Further promote the efficiency improvement of supply chain and the control of procurement cost by scale effect, optimize the terminal price and stimulate the sustained release of demand.

Xiaomi mobile phone is the core hardware entrance of Xiaomi and the cornerstone of Xiaomi’s ecology. The success of Xiaomi mobile phone is not only an industry dividend that benefits from the transformation of functional machines into smart phones and the rise of e-commerce channels, but also benefits from the successful application of Xiaomi’s cost-effective explosion strategy and the accurate grasp of the upgrading direction of mass consumption in the era of consumption upgrading.

In 2014, when the mobile phone business was in full swing, Xiaomi began to lay out the Xiaomi ecological chain with IoT intelligent hardware as the general direction. For Xiaomi, the core value of the vigorous development of eco-chain enterprises lies in maintaining and strengthening Xiaomi brand awareness through continuous promotion, building Xiaomi lifestyle through product chain, and then building Xiaomi ecological circle. Xiaomi Eco-chain Company is neither a simple OEM/ODM foundry nor a loose alliance formed by joint-stock investment, but a vertical product company that exports all aspects of supply chain, capital, brand and channel support, replicates Xiaomi product logic from 1 to n, and rapidly extends Xiaomi brand product line.

(A) Xiaomi product strategy: the main cost-effective explosion, ecological chain empowerment to expand the border.

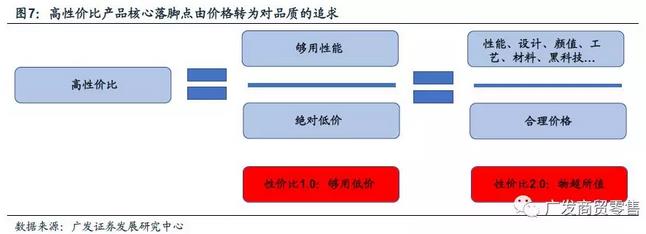

Xiaomi products practice strategies similar to Muji and Costco, so the pursuit of cost performance is the core strategy of Xiaomi products. The foothold of high cost performance is to improve the comprehensive quality of products such as product performance, design, face value and innovation rather than absolute low price, and to pursue the consumption upgrade of "high quality+reasonable price" in the mass consumer goods market.

Secondly, the product development starts from the principle of "meeting 80% demand of 80% users" and focuses on the functional demands of mainstream mass core products; Simplify the product line with explosive thinking, concentrate on resources such as design and research and development, reduce the difficulty of supply chain, and further improve the product cost performance by relying on the scale effect of single product.

Finally, the product line layout expansion adopts the ecological chain investment model. The front-end ensures that the tonality of product design is unified into a system and consolidates the brand awareness of Xiaomi; The back end empowers traditional manufacturing, giving full play to the enthusiasm of entrepreneurs and the advantages of China manufacturing.

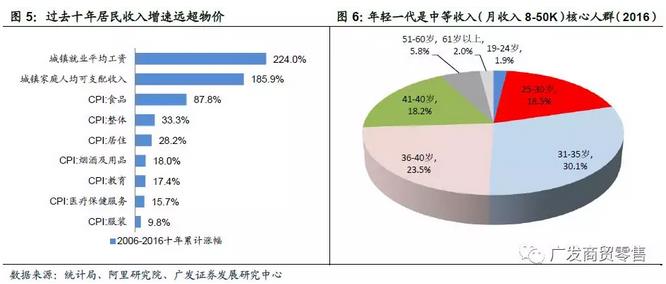

1) Quality-oriented high cost performance is the core demand of mass consumption upgrading and the core strategy of Xiaomi products. Compared with the last round of consumption upgrading centered on the popularization of consumer goods (typical household appliances), this round of consumption upgrading is more a replacement upgrade under the accumulation of income and wealth of millennials:

① When the popularity of consumer goods is basically completed (new products and new categories are difficult to appear) and consumers have the ability and willingness to pay a premium, compared with simple price competition, products that meet the quality and personalized demands of the younger generation are more likely to stand out;

② The popularity of the Internet eliminates information asymmetry. Convenient supply and price comparison channels make it difficult to maintain the false high price under the traditional redundant channels. While the consumption capacity is improved, it also pays more attention to the cost performance of goods. Behind the popularity of cross-border e-commerce and fast fashion brands with low markup ratio is the cost performance logic of consumption upgrading;

(3) The increase of income level drives the increase of consumers’ price affordability: According to statistics, during the decade from 2006 to 2016, the average urban employment wage/household disposable income increased by 224%/186%, much higher than the overall CPI increase of 33% in the same period. The foothold of the corresponding consumers’ pursuit of cost performance will gradually shift from absolute low price to the pursuit of comprehensive quality of products such as performance, design, value, innovation and tonality at a reasonable price.

The business model of hardware building ecology and service realizing user resources determines that Xiaomi has been the benchmark of high cost performance in the industry since its birth, and after continuous innovation in product design, research and development, technology and other fields in recent years, the definition of high cost performance of Xiaomi products has gradually changed from "sufficient low price" to "value for money" at reasonable prices.

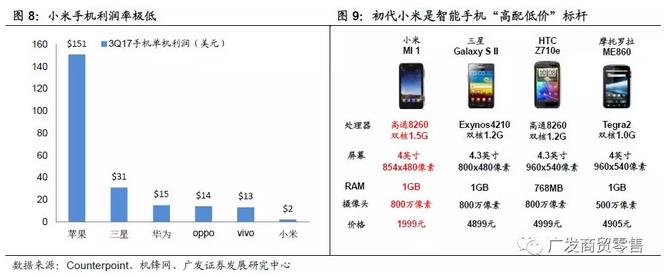

① The core hardware parameters of the first-generation Xiaomi MI1 mobile phone such as processor, screen resolution, RAM, camera, etc. are compared with international brands such as Samsung and HTC, but the price is less than half of that of rivals; According to Counterpoint data, in 3Q2017, the average stand-alone profit of Xiaomi mobile phone is only US$ 2, which is not only far below the level of Apple’s US$ 151, but also far below the level of domestic Android mobile phone manufacturers such as Huawei (US$ 15) and OPPO (US$ 14).

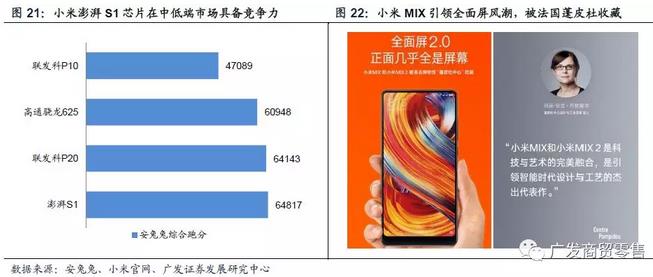

② Xiaomi’s mobile phone and eco-chain product ID design are leading peers. As of the first half of 2017, it has won 36 world top three design awards (German Red Dot, German IF and American IDEA); The MIX high-end flagship machine launched in September 2016 led the industry’s comprehensive screen innovation trend, and together with the MIX2 mobile phone launched in 2017, it was collected by Pompidou;

③ In February 2017, Xiaomi independently developed the mobile phone chip 澎湃 S1 and released it, becoming the second mainstream domestic mobile phone brand to release its own research chip after Huawei.

2) The 8080 principle defines product positioning, and the popularization of high-end products & the high quality of mass products promote consumption upgrading.Accurate product positioning includes many dimensions such as target users, function setting, quality control, product pricing, etc. Among them, the core problem lies in user group positioning and satisfaction of core functions (that is, solving "pain points"). Xiaomi’s product development follows the principle of "meeting 80% needs of 80% users" and is committed to the development and optimization of core functions, so as to focus on limited resources and solve the core pain points of users.

In the early years, Xiaomi’s mobile phone "refused to accept running a point" is an intuitive expression of the performance of the mobile phone, and the focus behind it is the common stuck problem of Android mobile phones in the early years; Mi band focuses on the three core functions of pedometer, alarm clock and sleep monitoring, and realizes 30-day long battery life by canceling the screen (adding the screen after the second generation technology upgrade), thus solving the embarrassment that peer products generally need frequent charging.

Under the principle of Xiaomi 8080 product development, the product line focuses on functional products with high standardization and versatility, and at the same time, it prevents the development cost from being too high due to the generalization of product functions, and the price of end products is greatly reduced in exchange for the improvement of efficiency, creating explosions, and further reducing the production cost of products by scale effect, realizing a virtuous circle of production and sales. The price of Xiaomi M1 mobile phone in 1999 and the price of Xiaomi 1st generation bracelet in 79 yuan were absolute "price butchers" with similar core functions in the industry at that time, which laid the foundation for the sales of phenomenal products.

From the perspective of consumption upgrading, the significance of Xiaomi 8080 principle lies in promoting mass consumption upgrading from two dimensions: popularization of high-end products and quality of mass products: the former focuses on lowering the price threshold for users to try (reducing non-core functions & mass production), while the latter focuses on improving product quality (solving and optimizing pain demand). Looking at Xiaomi’s eco-chain product line, products such as mobile phones (early days), smart TVs, bracelets, sweepers and balance cars can be classified as high-end products, while wiring boards, charging treasures, IH rice cookers and mobile phones (now) can be classified as mass products.

3) Ecological chain empowers to expand product boundaries and build a "rice noodle" lifestyle.Xiaomi focuses on functional products, but the product line expansion far exceeds that of ordinary companies. According to product types, it is mainly divided into four categories: ① Smartphone is the lowest core hardware and the starting point of the whole ecological chain; ② Expand mobile phone peripheral products such as mobile power supply, headphones and protective covers around different consumption scenarios of mobile phones; ③ Focus on home intelligent hardware products such as AI audio and video, smart TV, air purifier, balance car, smart desk lamp, etc. according to the IoT layout idea; ④ In addition to intelligent hardware products, develop functional consumables such as towels, bags, pens and mattresses. From intelligent hardware to daily consumables, create a "rice noodle" lifestyle in all directions.

From the perspective of product line layout expansion, Xiaomi adopts the eco-chain investment incubation mode to ensure that the single product development team focuses on four eco-chain entrances and control products: mobile phones, televisions, WIFI routers and AI speakers, and the rest of the eco-chain products set up joint ventures with leading enterprises in the industry (for example, 90-minute luggage cooperates with Kairun, a listed company, and iHealth smart sphygmomanometer cooperates with Jiu ‘an Medical, a medical device listed company), or invest in entrepreneurial teams with deep product and industry resources (for example) The founder of Huami Technology, the parent company of mi band, is the earliest technical expert who used Linux in embedded system in China.

Xiaomi exports a full set of resources such as brand, channel, supply chain and capital, and leads the product ID design, and the front-end ensures that the tonality of product design is unified into a system to consolidate Xiaomi brand awareness; The back end empowers traditional manufacturing, gives full play to the professionalism of entrepreneurs and the advantages of China manufacturing, replicates the successful model of Xiaomi mobile phone, and forms a pan-group and ecological growth model.

(2) Xiaomi mobile phone: the industry dividend is superimposed on the cost-effective revolution to create the ecological cornerstone of Xiaomi.

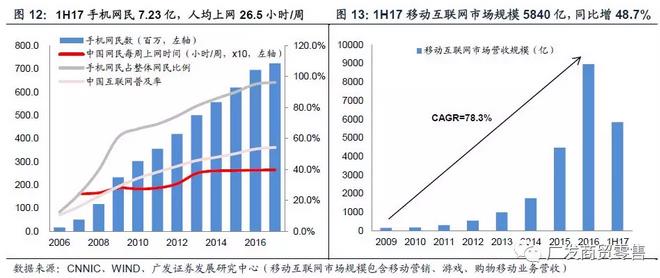

Just as QQ/ WeChat is the gateway to Tencent and Taobao is the gateway to Ali, mobile phones are the hardware cornerstone of the whole ecosystem (iPhone is the cornerstone of Apple’s ecology), because mobile phones have become the core infrastructure of the mobile Internet economy and the source of traffic connecting users and Internet services: According to CNNIC data, as of 1H2017, the number of domestic mobile phone users reached 724 million, accounting for 96.3% of the total netizens; The national average weekly online time is 26.5 hours. 1H17 The market scale based on mobile Internet (including mobile marketing, games and shopping) increased by 48.7% year-on-year to 584 billion yuan.

Xiaomi’s success first stems from the success of Xiaomi’s mobile phone. The explosive growth of Xiaomi mobile phone, on the one hand, benefited from the transformation of functional machines into smart phones and the rise of e-commerce channels, on the other hand, benefited from the successful application of Xiaomi’s cost-effective explosion strategy and the accurate grasp of the direction of mass consumption upgrading in the era of consumption upgrading.

The rapid replacement of traditional function machines by smart phones is an industry dividend for the rise of Xiaomi mobile phones. The commercial roll-out of 3G(2009) and 4G(2014) networks has greatly accelerated the mobile Internet. The launch of Apple iPhone(2007) and Google’s joint HTC& Samsung (2008) to develop Android smartphones has subverted consumers’ understanding of mobile phones in the traditional functional machine era. After the domestic mobile network accelerated greatly in 2010 (3G was officially rolled out), the wave of smart phones came quickly. According to the data of the Ministry of Industry and Information Technology, in 2011, domestic smartphone shipments reached 95 million units, accounting for 23% of mobile phone shipments in that year; By 2016, smartphone shipments reached a high of 522 million units, accounting for 93.2% of the total mobile phone shipments.

The outbreak of online shopping is the channel dividend for the success of Xiaomi mobile phone. The core distribution channels of mobile phones in the era of functional machines are operators and offline public channels. After 2010, domestic e-commerce began to rise rapidly: at that time, Taobao was deeply rooted in the hearts of young people. In that year, the sales of Double Eleven reached 940 million yuan, which witnessed the powerful explosive power of online shopping for the first time (the sales of the first Double Eleven in 2009 were only 50 million yuan); Two representative platforms, Dangdang and JD.COM, have successively listed/obtained huge financing (Dangdang landed on the NYSE in 2010 and raised $270 million; JD.COM received $1.5 billion in financing in 2011). Driven by the explosive power and capital of online shopping, major platforms started large-scale subsidy expansion, and online shopping entered an explosive growth period.

In addition to the two major bonuses of smart phones and online shopping, the success of Xiaomi’s mobile phone first cut into the two core pain points of high initial price of smart phones and stuck Android system, smoothing out the premium of international big brands and high brands, and filling in the quality worries of domestic shanzhai machines.

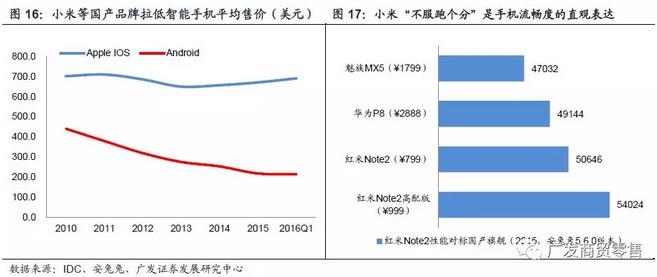

In the initial stage, smart phones were limited by supply chain efficiency and high R&D investment. Under the single-machine profitable sales strategy, branded mobile phones were priced in the high-end market. According to IDC statistics, in 2010, the average selling price of Apple’s iPhone series phones was $710, and the average selling price of Android phones reached $441 (3,000+RMB). Although the price of domestic knockoffs is low, there are frequent quality risks. Xiaomi’s pricing of 1999 yuan (Xiaomi series) and 799 yuan (Redmi series) greatly fills the lack of mass consumer-grade mobile phone brands, which is a typical representative of the popularization of high-end products and the quality of miscellaneous brands in the mobile phone market.

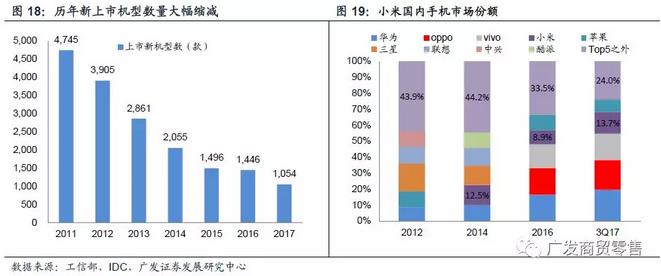

In 2016, domestic brands represented by Xiaomi have lowered the average selling price of Android phones to $215; At the same time, the number of models listed in the domestic mobile phone market dropped from 4,745 in 2011 to 1,054 in 2017; The market share of the top five mobile phone brands increased from 56.1% in 2012 to 76% in 3Q17, and the market share of Xiaomi mobile phone increased to 13.7% in the same period (Xiaomi mobile phone did not enter the top five in 2012).

In addition to the price, the initial Android mobile phone was limited in hardware configuration and insufficient in software optimization (the native Android system is similar to a "rough room" and needs fine decoration), and the problem of operation jam was widely criticized. On the one hand, Xiaomi insists on "high price and low allocation" in the hardware layer of mobile phone, and makes up for the inherent deficiency of mobile phone software with hardware performance; On the other hand, before Xiaomi officially released the mobile phone products, the MIUI system based on Android optimization had been iterated at a high speed for one year, accumulating hundreds of thousands of users (breaking a million in January of 12), which was one of the most popular third-party UIs for mobile phone enthusiasts at that time. The dual efforts of software and hardware made Xiaomi mobile phone almost the "best to use" mobile phone at that time, and the famous slogan "I don’t want to run a point" was an intuitive expression of the performance and smooth use of Xiaomi mobile phone.

Specific to the style of play, the success of Xiaomi mobile phone is the best practitioner of the cost-effective explosion product strategy:

1) Product line restraint.Xiaomi followed Apple’s example in the early years and maintained a flagship product strategy every year. In 2013, Xiaomi introduced the low-end product line Redmi series, introduced the business big-screen Note series in 2015, and opened the high-end MIX flagship series in 2016. Up to now, classified by price segment, Xiaomi mobile phone mainly includes four product lines: MIX flagship focuses on high-end (more than 3000 yuan), MI series &Note series (big screen) focuses on mid-end (2000-3000 yuan), and Redmi series focuses on entry market (1000 yuan).

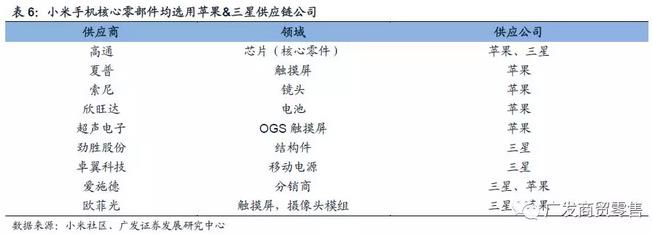

2) "Sufficient materials" for core components.The supply chain of core components of Xiaomi mobile phone adopts the same quality suppliers from Apple and Samsung to ensure the basic quality control of products and the stability of the supply chain. At the same time, Xiaomi is also in the leading group in China in R&D investment. In February, 2017, Xiaomi officially released its first mobile phone chip, Songguo S1, and put it on the market in its new Redmi 5C machine. Xiaomi became the second mainstream mobile phone manufacturer in China to release self-developed chips after Huawei. In November 2017, MediaTek COO Zhu Shangzu joined Xiaomi as a partner in the industrial investment department, and Xiaomi’s independent mobile phone chip research and development investment went up a storey still higher.

3) ID design of "face value is justice".With the rapid iterative development of smart phone industry, there is little difference in performance between brands, especially among flagship phones, so ID design has increasingly become an important factor to distinguish brands from flagship machine. Xiaomi officially launched the MIX full-screen mobile phone in September 2016, which immediately led the full-screen trend of mainstream mobile phone manufacturers in 2017. In December 2017, after being collected by the National Design Museum of Finland, the small MIX series mobile phones were collected by the Pompidou Center of France (listed as the three major museums in Paris together with the Louvre and the Art Museum of Ossetia), and were hailed as "the perfect integration of technology and art, which is an outstanding masterpiece leading the design and technology in the intelligent age".

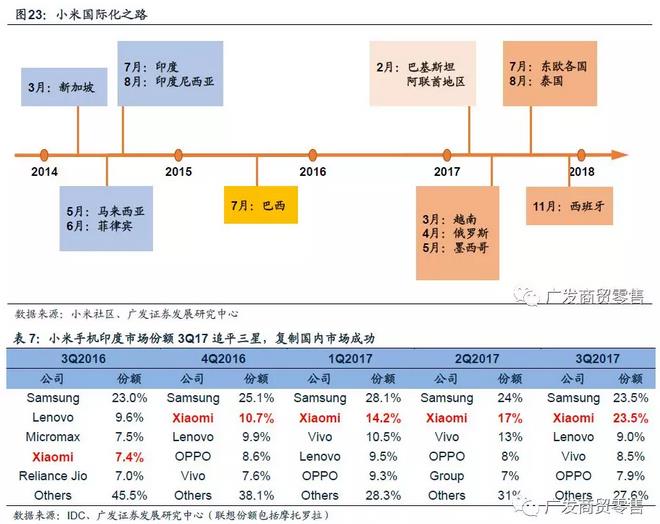

In March, 2014, Xiaomi mobile phone entered Singapore, and started the internationalization and expansion of Zhang Zhilu. Since then, with the Indian market as the core, Xiaomi mobile phone has effectively replicated its cost-effective explosion strategy in China in major developing countries, and overseas markets have blossomed in an all-round way:

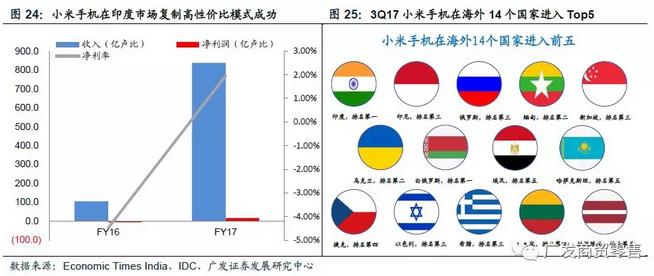

According to India’s Economic Times India report, FY2017 (as of the end of March) Xiaomi’s revenue in India reached 83.79 billion rupees (about 8.44 billion RMB), a year-on-year increase of over 700% and achieved profitability. According to IDC data, the market share of 3Q2017 Xiaomi mobile phone in India climbed to 23.5%, which tied with Samsung as the largest mobile phone brand in India. In addition, Xiaomi has gained a firm foothold in Southeast Asian markets such as Indonesia and Vietnam, Eastern European markets such as the Czech Republic and Ukraine, and Middle East markets such as Israel and the United Arab Emirates. The market share of Xiaomi’s mobile phones in 14 overseas countries and regions has entered the top five.

(C) Xiaomi ecological chain: layout IoT, bamboo forest ecology copied from 1 to N.

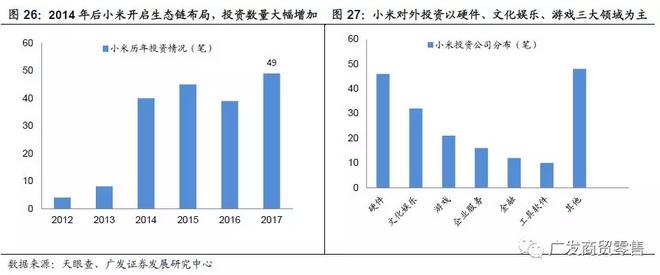

In 2014, when the mobile phone business was in full swing, Xiaomi began to invest in incubating Xiaomi eco-chain enterprises with mobile phone peripherals and intelligent hardware products as the core. According to the data of Tianyancha, in 2014, Xiaomi’s foreign investment increased to 40 (only 4/8 in 2012/2013). By the end of 2017, Xiaomi’s accumulated foreign investment reached 185, focusing on the early financing of Angel Wheel (53) and A Wheel (56) in the fields of intelligent hardware (46), culture and entertainment (32) and game services (21), and comprehensively arranging IoT.

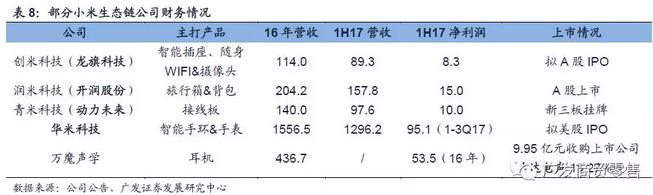

According to the official disclosure, by the end of 2016, there were 77 Xiaomi eco-chain enterprises, of which 30 released products, 16 companies had an annual income of over 100 million, and 3 companies had an annual income of over 1 billion, including Huami Technology (mi band & Watch), Zimi Technology (Xiaomi Mobile Power Supply), Wanmo Acoustics (Xiaomi Headphones), Power Future (Xiaomi Wiring Board) and Runmi Technology (90 Suitcases).

For Xiaomi, the core value of the vigorous development of eco-chain enterprises lies in maintaining and strengthening Xiaomi brand awareness through continuous promotion, building Xiaomi lifestyle through product chain, and then building Xiaomi ecological circle.

1) The success of the mobile phone market has established a basic user disk for Xiaomi’s ecosystem. However, compared with the high user stickiness built by Apple’s mobile phone with absolute product strength and IOS system specificity, Xiaomi’s mobile phone needs to face the competition from many manufacturers in the Android camp. Under the background that the competitiveness of a single product cannot be absolutely ahead, it needs to rely on eco-chain products to strengthen the user’s stickiness to the ecosystem;

2) The mobile phone is a durable consumer product, and under the rhythm of the main product of "one flagship every year", it is difficult for Xiaomi to maintain a sustained brand popularity by relying solely on mobile phones, and the exposure and release of products of eco-chain enterprises has greatly broadened the Xiaomi user base while maintaining the brand popularity (according to the Xiaomi Eco-chain Battlefield Notes, as of 2016, only about one third of Xiaomi eco-chain product users are Xiaomi mobile phone users, and the rest are Apple).

3) In addition to the core entrance of mobile phones, the IoT boom represented by smart homes is in the ascendant. The deep cultivation of Xiaomi eco-chain enterprises in the field of intelligent hardware is undoubtedly the ticket for Xiaomi’s leading peers to the IoT era.

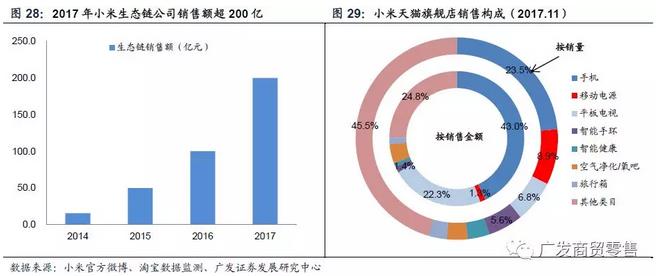

In 2017, the revenue of Xiaomi Eco-chain enterprises exceeded 20 billion yuan, doubling year-on-year, and has already formed a new product growth point outside the mobile phone. Taking the data of Xiaomi Tmall flagship store in November 2017 as an example, the total sales volume of Xiaomi mobile phones in stores has dropped to 23.5% (the sales amount accounts for 43%).

On the day of the Double Eleven, Xiaomi TV (32/43/49/55-inch same-foot segment Tmall sold first), Xiaomi notebook (Tmall notebook sold first), Xiaomi air purifier (Tmall/JD.COM/Suning three platforms first), mi band (Tmall/JD.COM/Suning three platforms bracelet category first), No.9 balance car (No.

In terms of capital market operation, many Xiaomi eco-chain companies have/intend to land in the capital market. By the end of 2017, Runmi (parent company Kairun shares) and Qingmi (parent company power future) have landed on A shares and New Third Board respectively; Chuangmi (parent company Longqi Technology) and Huami Technology plan to IPO in A shares and US stocks respectively; Wanmo Acoustics acquired a total of 15.27% equity of the listed company in cash of 995 million yuan and became its controlling shareholder.

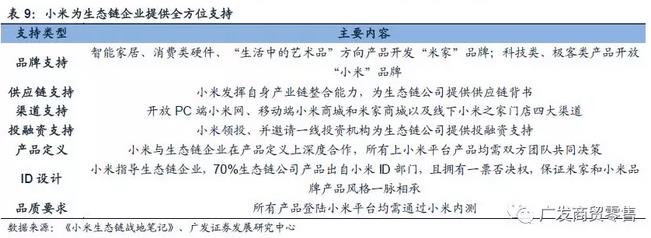

Xiaomi Eco-chain Company is neither a simple OEM/ODM foundry company nor a loose alliance formed by equity investment, but a vertical product company that exports all aspects of supply chain, capital, brand and channel support, replicates Xiaomi product logic from 1 to n, and rapidly extends Xiaomi brand product line. Specifically, Xiaomi mainly provides seven major supports for eco-chain companies:

1) Brand support. Xiaomi opens two brands of "Mijia" and "Xiaomi" to the products of eco-chain companies that meet the requirements. The former is mainly aimed at smart home, consumer hardware, and products oriented to "art in life"; The latter is mainly aimed at technology and geek products.

2) Supply chain support. Xiaomi gives full play to its accumulated credibility and bargaining power in the electronic industry chain, and provides endorsements for eco-chain companies.

3) Channel support. Open omni-channel sales support such as Xiaomi.com on PC side, Xiaomi Mall on mobile side, Mijia Youpin and Xiaomi House offline, and provide crowdfunding channels for new product research and development.

4) Investment and financing support. Xiaomi & Shunwei Fund leads the investment (usually holding 10-30% of the shares), and at the same time, according to the development stage, Xiaomi invites first-line investment institutions to participate in the financing roadshow of eco-chain companies in batches.

5) product definition. Xiaomi and Eco-chain Company have deep cooperation in product definition, and all products on Xiaomi platform need to be jointly decided by both teams;

6)ID design. Xiaomi guides eco-chain enterprises in design, and reserves one vote of veto in the ID department of eco-chain companies to ensure that the design styles of "Mijia" and "Xiaomi" brand products come down in one continuous line and their values are unified.

7) Quality requirements. Xiaomi’s output quality management requirements require that all eco-chain products must pass Xiaomi’s internal testing and screening when landing on all platforms of Xiaomi.

In terms of product pricing and sales, "Xiaomi" and "Mijia" brand products must abide by the exclusive cooperation agreement between the two parties (self-priced sales of self-owned brand products of eco-chain enterprises): 1) Xiaomi and Mijia (including other channels operated or licensed by Xiaomi, such as Xiaomi Tmall flagship store and offline Xiaomi specialty store) are the only exclusive sales channels of eco-chain products; 2) Xiaomi purchases the products in full at the product manufacturing cost price (including raw materials, packaging and transportation, depreciation of labor and special equipment, etc.); 3) Xiaomi and Eco-chain Company divide the product sales profit (generally 50:50); 4) Product terminal pricing is jointly decided by Xiaomi and eco-chain enterprises.

Taking Huami Technology (mi band manufacturer) as an example, we illustrate the operating mode of Xiaomi Eco-chain enterprise.

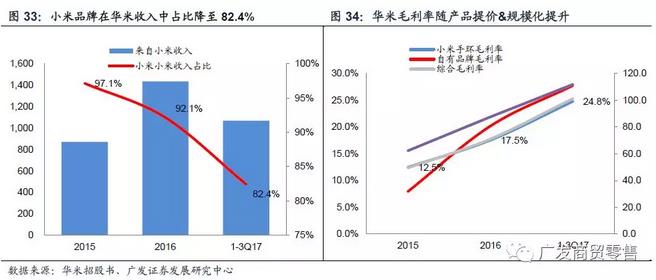

Huami Technology was established in January 2014. The founder is Huang Wang, a continuous entrepreneur of technical intelligent hardware who graduated from China University of Science and Technology (once worked for Huawei, and was the first technical expert to use Linux in embedded systems in China). The main products are mi band (the core item) and Xiaomi weighing scale, and smart wearable products are produced and sold under his own brand Amazfit. According to the disclosure in the prospectus, Xiaomi holds 19.3% equity of Huami Technology through its fund People Better limited, and Xiaomi’s related party Shunwei Capital holds another 20.4% equity.

The core product of Huami Technology is mi band, and its operation completely follows the product operation idea of Xiaomi Migao’s cost-effective explosion: 1) In terms of functional design, mi band focuses on the three core functions of step counting, alarm clock and sleep monitoring, and removes secondary functions such as call, touch and music playback; 2) Cancel the screen (added after the second-generation product technology upgrade) to reduce power consumption, achieve 30-day long battery life, and solve the pain point of frequent charging of peer products; 3) Pricing in 79 yuan (the second generation product is priced at 149 yuan), which is much lower than that of peers with a price of more than 1,000 yuan, greatly reducing the cost of early adopters. At the same time, colorful wristbands are provided for young users to change colors.

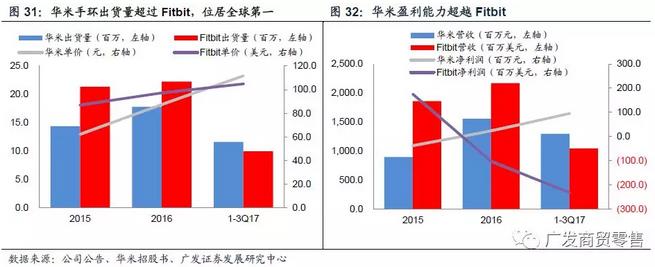

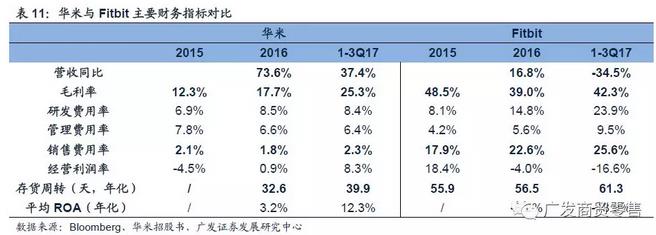

Financial data confirms the success of Huamei’s product strategy of high price explosion. Under the strategy of high cost-effective explosive products, we rely on the large-scale production and sales of single products to improve operational efficiency and achieve large-scale profitability with "low net interest rate+high turnover rate". The first three quarters of 2017:

1) The shipment of Huami bracelet reached 11.6 million, surpassing Fitbit to become the world’s largest smart wearable brand; Operating income increased by 37.4% year-on-year to 1.296 billion yuan (the proportion of revenue from Xiaomi decreased from 92.1% in 2016 to 82.4%); The net profit was 95 million yuan, a year-on-year loss; In the same period, Fitbit revenue decreased by 34.5% year-on-year to $1.04 billion, with a net loss of $230 million.

2) The overall gross profit margin of Huami reached 25.3%, which was significantly higher than that of 17.7% in 2016, mainly due to the increase in the average sales unit price of products (the proportion of second-generation and private brand products in mi band increased) from 87.4 yuan to 111.7 yuan, and the scale effect of the supply chain was highlighted after the sales of single products increased significantly, but compared with Fitbit’s gross profit margin of 42.3% in the same period, the characteristics of Huami bracelet with high cost performance were still obvious.

3) The advantages of cost and turnover are the core of Huami’s profit. The R&D expense ratio of Huami is 8.4% (equivalent to the level of Fitbit in 2015), and the sales expense ratio/management fee rate is only 2.3%/6.4%(VS Fitbit is 25.6%/9.5% in the same period); At the same time, the turnover days of Huami inventory is only 39.9 days (annualized), which is much better than Fitbit’s performance of 61.3 days, thus achieving a net interest rate of 7.3% and a ROA (annualized) of 12.3% with a gross profit margin of 25.3%, and the large-scale profitability began to stand out.

New Retail Xiaomi: Omni-channel Strategy for Winning Efficiency

New retail is Xiaomi’s channel strategy, which seeks to improve the efficiency of product circulation. Xiaomi was born in the Internet, and fully enjoyed the channel bonus of online low traffic cost in the early stage of growth. In addition, the number of SKUs under the explosion strategy is extremely limited. From brand image building to sales channels, focusing on the younger generation, the Internet is undoubtedly a more efficient choice. After 2016, the traffic dividend faded and the brand competition intensified, and the Internet channel became more and more crowded. The expansion of the eco-chain product line, on the one hand, makes the brand positioning of Xiaomi gradually expand from "Internet geek with high cost performance" to "national science and technology life" brand; On the other hand, smart new products continue to be launched, and the demand for offline physical experience is getting stronger and stronger, and the comprehensive cost-effective advantage of physical channels reappears.

No matter what the presentation form is, the new retail is the reconstruction of the three retail elements of people, goods and markets, and the essence behind it is the omni-channel integration and data operation promoted by technology, thus achieving a significant improvement in operating efficiency. The promotion of Xiaomi’s eco-cost-effective product strategy not only needs to focus on the core pain points in the production process with the "8080 principle" to create explosions, but also needs to optimize the circulation and promotion links to achieve efficient operation of the whole product link. From the focus line to the omni-channel layout, Xiaomi consistently pursues the ultimate efficiency.

(A) from the Internet, reputation is king of national science and technology brand of life.

Xiaomi was born and rose on the Internet, and fully enjoyed the online traffic dividend. It is also one of the few models that successfully landed and turned into an omni-channel national brand. From the perspective of brand building, the Internet thinking of "focus, extreme, word of mouth and fast" put forward by Lei Jun in his early years is the brand building and communication idea that Xiaomi’s word of mouth is king: focus and extreme are product goals; Fast, is the code of conduct; Word of mouth is the core of Internet thinking.

In the shaping of good word-of-mouth, good products are the engine, which is the first in establishing word-of-mouth, and all brand marketing is the second. Social media is the accelerator of word-of-mouth communication, which promotes the viral spread of brand image on the Internet. Equal user relationship is the relationship chain of word-of-mouth communication, making friends with users, allowing users to participate in product discussion, design and demand collection, and becoming the "tap water" of products.

Li Wanqiang, vice president of Xiaomi, described the process of brand building of Xiaomi in detail in "Sense of Participation", which can be summed up as three strategies: "making explosive products, being fans and being self-media" and three tactics: "opening up participating nodes, designing interactive ways and spreading word-of-mouth events".

In terms of strategy, 1) "making explosive products" is a product strategy, that is, we should focus on the product scale stage, achieve the first market segmentation, and gather resources to form scale effect; 2) "Being a fan" is a user strategy, that is, to seek the transformation from weak user relationship (purchase) to strong user relationship with stronger trust ("tap water") and become a fan of products and even brands; 3) "Being self-media" is a content strategy, that is, making the enterprise itself an information node of the Internet, encouraging employees and users to become product spokespersons, and guiding users to participate in interaction and share diffusion.

Tactically, 1) "open participation nodes" means opening all links of products, services, sales and brand promotion, looking for nodes that benefit both parties, so that users can deeply participate in them; 2) "Design interaction mode" means following the design idea of "simple, beneficial, interesting and real" to facilitate users to participate in interaction; 3) "Spreading word-of-mouth events" means screening a group of "fans" with high product recognition in advance, fermenting the sense of participation on a small scale, making the content generated based on interaction into topics and events that can spread, and making word-of-mouth fission and spread.

The "orange Friday" development model of Xiaomi’s early MIUI system is not only a typical example of the "three three" rule. With 100 core official engineers, MIUI has established a development team covering 100,000 forum users to realize a new experience of refreshing every Friday. 1) Open participation nodes: except for the engineer’s code writing part, product requirements, testing and release are open to users to participate, Xiaomi iterates the system according to users’ opinions, and users get the functions and products they want; 2) Design the interactive mode: based on the forum discussion and feedback, collect the requirements, and regularly release the system update package every Friday; 3) Spreading word-of-mouth events: In addition to MIUI’s encouraging sharing mechanism, Xiaomi also filmed the micro-film "Sponsor of 100 Dreams" for the first 100 users who participated in the measurement, amplifying the "sense of participation".

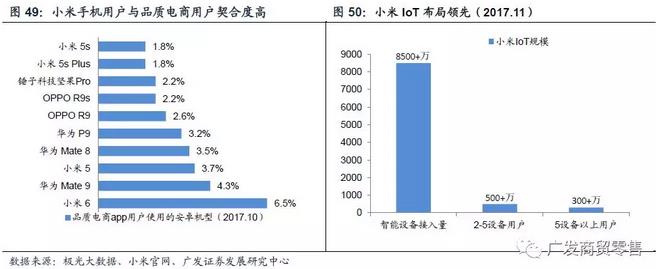

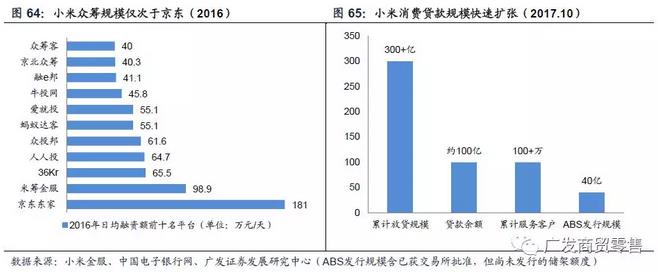

In 2014, the sales scale of Xiaomi official website reached 35.14 billion yuan, and the market share of e-commerce reached 3% in that year. The scale of B2C e-commerce was second only to Tmall and JD.COM, ranking the third largest e-commerce platform in China; In 2017, the sales scale of Xiaomi Tmall flagship store reached 2.46 billion yuan in a single day, occupying the Tmall Double Eleven brand store king for many years in a row and being the first Internet brand.

After 2015, the online traffic dividend tends to decline, and after years of popularization of smart phones, the incremental demand has shifted from the first and second lines to the third and fourth lines and even the township-level market, while the e-commerce that Xiaomi relies on to grow has not yet dominated the low-line market, and the short board missing offline has begun to stand out. In September, 2015, the first Xiaomi House under Xiaomi Line opened in Beijing Contemporary Mall (previously, "Xiaomi House" was only positioned as an after-sales service and maintenance outlet), and Xiaomi began to enter offline retail.

In response, in July 2016, Xiaomi changed its tradition and invited three popular stars, Wu Xiubo, Liu Shishi and Haoran Liu, to endorse the red rice mobile phone, highlighting the positioning of Redmi’s "national mobile phone"; In October of the same year, Xiaomi launched the Note2 mobile phone with a big business screen, and invited Tony Leung Chiu Wai to speak for it. After entering 2017, with the omni-channel transformation and the positioning of national mobile phones, Xiaomi further invited Wu Yifan and SNH48 to speak for their mobile phones, fully enabled traffic stars of all ages, and sponsored popular variety shows such as "Qi Pa Shuo", "Hip-hop in China" and "Our Travel". In addition, the eco-chain product line and Xiaomi House stores were quickly rolled out, and Xiaomi was fully launched by the Internet.

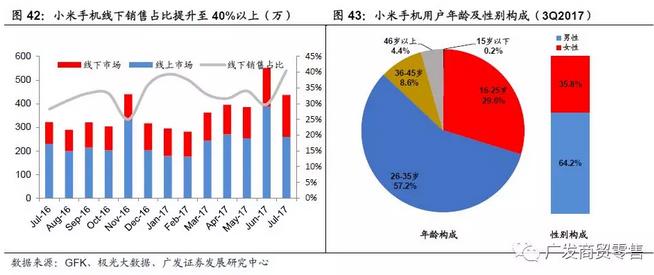

According to GFK data, in July 2017, the offline sales of Xiaomi mobile phones accounted for 41%; Aurora big data shows that in 3Q2017, among Xiaomi mobile phone users, young users aged 16-25 accounted for only 29.6%, main users aged 26-35 accounted for 57.2%, and users over 36 accounted for 13%; At the same time, female users accounted for 35.8%. In addition, among the users of Xiaomi’s ecological chain, Xiaomi’s mobile phone users only account for about 1/3, and Xiaomi has completely changed from positioning young people’s Internet mobile phone brands to national technology life brands.

(2) E-commerce Xiaomi: quality e-commerce, a new generation of e-commerce platform.

In April, 2016, Netease launched the e-commerce platform Netease YEATION. The front end relied on the entrance diversion of Netease departments, such as Netease Mailbox and Youdao Cloud, and the back end skipped the traditional distribution link and directly docked with big brands’ foundries. The platform endorsed the product quality and focused on the high quality and cost performance of "good life, not so expensive", which was a great success. According to publicly disclosed data, as of September 2016, Netease YEATION released a total of 30 million registered users for half a year, with a monthly flow of 60 million yuan; Ding Lei, CEO of Netease, set a "small goal" for Netease YEATION to reach 7 billion yuan/20 billion yuan in 17/18 in the earnings conference call at the beginning of 17 years.

Since 2017, quality e-commerce platforms (or brands) have been launched one after another, including Xiaomi’s products (born out of Xiaomi’s smart home control platform "Mijia App"), Ali’s Taobao Heart Selection, Suning’s polar products, JD.COM’s Beijing-made products, etc., and become an absolute hot spot in the market. Although the specific operation modes are different, we believe that the main focus of quality e-commerce is mass consumption upgrade, the core keyword is quality-oriented high cost performance, and the realization method is platform folding supply chain docking upstream factories, and relying on platform credit endorsement quality.

The basic meaning of selling is to meet consumers’ consumption demand, and the changes of core consumption demands of main consumer groups in different social development environments will promote the evolution of corresponding dividend formats. The particularity of the domestic market lies in the huge difference in regional development level, which makes different formats parallel at the same time dimension. Judging from the overseas mature markets and domestic development experience, offline retail has basically gone through the process of free market, hypermarket-department store (such as Wal-Mart), outlet (strictly speaking, outlet is a variety of department store), and gradually evolved into selected stores (such as Costco Costco Costco and Muji).

The logic of market operation has correspondingly undergone a transformation from product-oriented (material scarcity) to channel-oriented (information asymmetry), and then to user-oriented (meeting the diversified needs of users such as cost performance and experience). During this period, the control of channels on the supply chain has been continuously improved, and channels have been deeply involved in the supply chain to improve efficiency and meet the increasingly critical product needs of users.

Different from the traditional e-commerce form, we believe that quality e-commerce is essentially the evolution of online e-commerce format, and its direction corresponds to the trend of offline dividend format change: the migration of C2C Taobao to B2C Tmall & JD.COM is the evolution of e-commerce low-price drive to brand & service drive; The rise of quality e-commerce is a process of e-commerce quality-selection and cost-effective drive migration based on one-stop shopping of B2C integrated e-commerce.

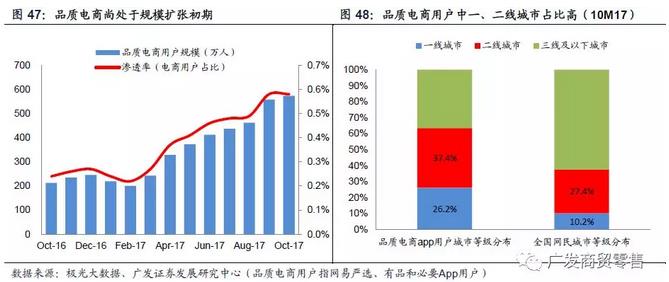

At present, it is the initial stage of the outbreak and growth of the quality e-commerce platform, which has yet to be expanded from the niche to the mass. According to Aurora Big Data, in October 2017, the number of monthly users of quality e-commerce was about 5.73 million (only counting the number of users of Netease YEATION, Mijia Youpin and Necessary three independent apps), which increased by 170% year-on-year, accounting for only 0.58% of the total mobile Internet users, about one-tenth of the 580 million monthly users of mobile phone Taobao (12M17); From the perspective of user distribution, the proportion of quality e-commerce users in first-and second-tier cities reached 63.6%, which was much higher than the proportion of users in first-and second-tier cities as a whole among netizens in the same period of 37.6%.

Xiaomi’s Mijia Youpin e-commerce platform was originally an e-commerce module under Xiaomi’s smart home control platform "Mijia" App. In April 2017, Mijia Youpin (now renamed "Youpin") independent App was officially launched, and the Xiaomi system quality e-commerce platform went to the front desk. Product e-commerce focuses on Xiaomi and Mijia eco-chain products, and absorbs high-quality third-party brands to settle in, forming a quality e-commerce platform with intelligent hardware and technology products as the mainstay and full category coverage. Compared with Netease YEATION, Mijia has the following advantages:

1) Anterior drainage. Mijia Youpin started with "rice flour", with online traffic resources of Xiaomi intelligent software and hardware, and store experience promotion resources with Xiaomi House as the core (opening a hotel in YEATION in conjunction with Atour is also an expansion of offline experience resources, but the short-term quantity is extremely limited);

2) Back-end supply chain integration. There are products that focus on Xiaomi and eco-chain enterprise intelligent hardware products, which are unparalleled in the supply chain resources of scientific and technological hardware products in China. And after accumulating sticky user resources with high-priced hardware, select third-party brand merchants to expand low-priced products such as daily shopping, home furnishing, catering, etc. to achieve full category coverage, and the expansion difficulty is relatively small (as an analogy, JD.COM also started with low-frequency consumption, and started with 3C with high customer list, which was originally less difficult than Dangdang with low customer list books);

3)IoT "remote control e-commerce" function. Xiaomi IoT ecosystem is leading in China, and its potential application has great imagination. As far as e-commerce sales are concerned, the precise push and one-click purchase that Mijia intelligent platform can achieve by monitoring the accumulated big data in real time is far from being comparable to the general platform. Related recommendation (for example, Xiaomi humidifier monitors the poor water quality of users and pushes water purifier products; Xiaomi rice cooker recommends brand rice according to users’ preferences), consumables purchase (for example, air purifier & automatic recommended purchase when the filter element of water purifier runs out), and overall collocation (the design style of Xiaomi ecological products is unified, and all of them can be controlled by Mijia App), etc. The potential "remote control e-commerce" system of Xiaomi Ecology has great development potential.

(C) the new retail millet: channel integration, efficiency jump.

In September 2015, Xiaomi’s first offline direct sales store "Xiaomi Home" opened in Beijing Contemporary Shopping Mall, and Xiaomi officially entered the offline retail market. After exploring the experiment in 2016, Xiaomi put forward the goal of 1,000 stores in three years at the beginning of 2017, and began to rush to accelerate the expansion. In the whole year, 235 stores were opened to 287 stores, which became one of the most eye-catching offline new retail formats in 2017.

We believe that after the 8090 generation rose to be the main consumer group, the change of consumption habits brought about the reconstruction of the three retail elements of people, goods and markets, promoted the omni-channel integration and digital operation, improved the user experience, and brought about a significant improvement in operational efficiency.

1) The change of "people" is the core factor to promote industry change. The generation of 8090 has grown into a new main consumer group, thus giving birth to industry changes, and new brands, new ideas, new services, new marketing and new formats that meet their needs have gradually emerged; At the same time, it also puts forward new requirements for retail employees, from the past simple commodity sales to service users;

2) The change of "field" means the transformation and innovation of retail format to meet the needs of users for consumption anytime and anywhere and omni-channel integrated operation (such as unified inventory management with electronic price tag as standard in stores; Hanging system store picking support online operation); At the same time, it is also necessary to combine omni-channel data accumulation to guide site selection, dynamic line design and combination of formats and categories to promote the digitalization of offline user behavior;

3) the change of "goods" lies in returning to the essence of retail efficiency, guiding the selection of goods by data, improving the efficiency of supply chain, and screening quality and branded goods in line with the trend of consumption upgrading; And achieve omni-channel inventory access, providing unified inventory management for front-end formats.

Xiaomi’s new retail core pursuit is omni-channel coverage of users, which promotes the significant improvement of store operation efficiency;

1) The offline channel is mainly direct-operated Xiaomi Home, and at the same time, two types of franchisees are opened, namely, Xiaomi Specialty Store (franchisee site selection and construction, Xiaomi operation) and Xiaomi Home Authorized Store (franchisee site selection and construction, Xiaomi provides guidance), and settled in Suning and other offline mainstream electrical chain stores;

2) Online channels are dominated by e-commerce platforms with products (including the entrance of Mijia platform) and Xiaomi Mall, and at the same time, they are stationed in mainstream e-commerce platforms such as Tmall, JD.COM and Suning.cn;

3) All categories are covered online and offline, but offline stores select traffic explosions and new products, emphasizing experience and efficiency; Online, the whole line of products is covered, emphasizing one-stop satisfaction.

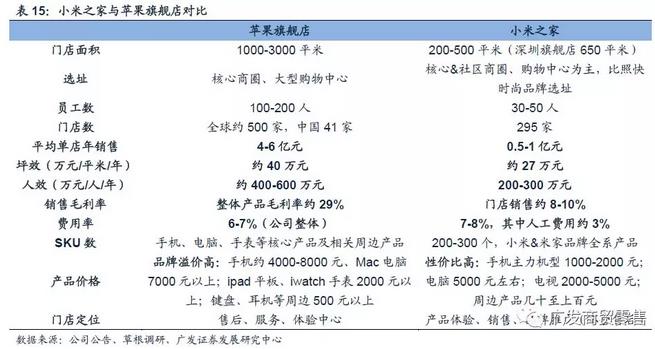

According to official public data, the typical store area of Xiaomi Home is about 200-500 square meters (Shenzhen flagship store opened in November 2017 is about 650 square meters), and the floor efficiency of the store reaches about 270,000 yuan/square meter/year, which is much higher than the level of ordinary offline chain stores of 10-50,000 yuan/square meter/year, and is second only to Apple’s official experience store in the world (about 400,000 yuan/square meter/year). Apple and Xiaomi are both star product companies involved in the retail sector ("manufacturing retail companies"), and the economic effect of brand fans built by the strong competitiveness of their products is the basis for their success. However, comparing the two phenomenal retail stores of Apple and Xiaomi, there are some differences in their operations:

1) Store positioning and expansion strategy.Apple retail stores are located as product experience, image promotion and after-sales service centers, with a large store area (1,000-3,000 square meters). They are located in core business districts and large shopping centers, and the number of stores and SKUs of store products are limited. As of 2017, there are about 500 official retail stores in the world, of which only 41 have opened stores in China for ten years (the first store was Sanlitun store opened in 2008).

Store products are mainly Apple core products such as mobile phones, computers and watches, and related peripheral products such as headphones and keyboards; Xiaomi Home is also positioned to promote product experience, but its sales attributes are stronger (the store does not support after-sales service), and its store area is smaller (200-500 square meters, Shenzhen flagship store is 650 square meters). Compared with fast fashion brands, the site selection focuses on shopping centers in the core-community business district, with intensive stores (295 stores have been opened on New Year’s Day in the past 18 years; Only 15 stores have been opened in Beijing), and the number of SKUs in the stores is about 200-300, covering the full range of hot-selling explosions and new products of Xiaomi and Eco-chain Company.

2) product pricing and profit strategy.Apple attracts "fruit powder" with absolute product innovation, leading the industry, high brand premium, high-end pricing of all series products, and strong profitability of hardware itself (the proportion of software service revenue is increasing, but the proportion is still limited, FY2017 is 13.7%). FY2017, the gross profit margin of overall hardware sales of Apple products is 29%, and the average single-machine profit of mobile phones reaches 151 US dollars (3Q17); Xiaomi products are based on high cost performance, pursuing to build an ecosystem with intelligent hardware, and then realizing user value with services. The pricing of the whole series of products is close to the people, and the profitability of hardware items is limited. The unit price profit of core mobile phone products is only 2 dollars (3Q17), and the gross profit margin of store products is only 8-10%.

Lei Jun, the founder of Xiaomi, disclosed Xiaomi’s new retail core play in an exclusive interview in October 2017, that is, according to the formula of retail = flow x conversion rate x customer unit price x repurchase rate, retail (flat efficiency) was disassembled into four steps and eight strategies, and each step was done to the extreme:

1) flow.Traffic is passenger flow, and the promotion depends on the location of stores and the combination of goods. The location of Xiaomi House is mainly located in shopping centers in the core or community business districts of first-and second-tier cities, and fast fashion and leisure brands such as Uniqlo, Starbucks and MUJI, which are close to the target customers, set up stores on the benchmark and drain each other. At the same time, we pay attention to the collocation of consumption scenes in the store product sampling. The products cover 200-300 SKUs in 20-30 categories, and are updated in time (even on the leading line) to ensure the "shopping" of the store.

2) conversion rate.The core of improving the conversion rate of passenger flow to store consumption is that the products are attractive enough. On the one hand, Xiaomi’s own brand gene emphasizes the ultimate explosion, which is known for its cost performance, and the product itself has enough consumer appeal. On the other hand, the selection of SKUs in stores is based on the accumulation of online sales data, and 200-300 SKUs in stores are based on the secondary selection of 20,000 SKUs of quality e-commerce, which promotes the transformation of high consumption of store passengers.

3) Customer unit price.The increase of customer unit price is not to raise the price of single product, but to achieve it by increasing consumption. The appearance design value of Xiaomi ecosystem products is unified, and the technical functions are interrelated (which can be controlled by Mijia App or Xiaomi AI speaker network), and the proportion of joint sales and even overall arbitrage is high. In addition, offline stores naturally have the advantage of experience, coupled with offline synchronization of new products online, and experience the charm of Xiaomi products in kind.

4) Repurchase rate.The improvement of repeat purchase rate is not only the result of strengthening brand awareness, but also the need to provide convenient purchase channels. Xiaomi products consistently adhere to the concept of high cost performance, and the online content and offline store three-dimensional communication with word of mouth are king, shaping Xiaomi Migao’s cost-effective national science and technology life brand awareness. Through the omni-channel layout, users can consume at any time and place, and at the same time, the online registration experience of consumer guide users in the store is used, and the offline selected explosions are used to drain the full range of Xiaomi ecological products with richer online experience for users.

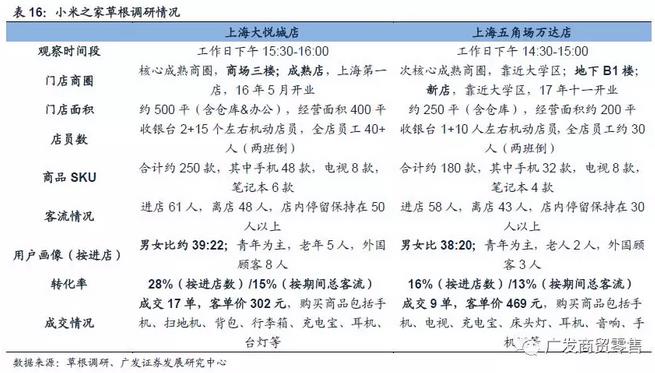

In December 2017, we conducted a grassroots survey of Xiaomi Home Shanghai Joy City Store and Shanghai Wujiaochang Store, and measured the operation of Xiaomi Home based on the survey data of first-hand stores. Among them, Joy City Store covers an area of about 500 square meters (including warehouse and office) and its business area is about 400 square meters. It is located on the third floor of Joy City in Jing ‘an, Shanghai. The store opened in May 2016. It is the first store of Xiaomi House in Shanghai and one of the six benchmark stores with annual sales exceeding 100 million. Wujiaochang Store opened in November, 2017, with an area of about 250 square meters (including warehouse) and a business area of about 200 square meters. It is located in B1 Building, wanda plaza, Wujiaochang, adjacent to Wujiaochang University District. We conducted a half-hour grass-roots investigation on the store in the afternoon on weekdays, and recorded the operation of the store from the dimensions of passenger flow, transaction, goods and clerk.

1) passenger flow.Neither of the two stores is located in a prime location on the first floor, but the passenger flow is far superior to the surrounding stores, and the passenger flow composition obviously breaks through the typical user impression of Xiaomi’s "young men aged 18-30". During our observation for half an hour: ① Joy City Store has accumulated 61 customers, and the number of customers staying in the store is maintained at around 50; The ratio of male to female customers entering the store is close to 2:1(39:22), mainly young people, but also including 5 elderly people and 8 foreign customers; ② Wujiaochang Store has accumulated 58 people into the store, and the number of customers staying in the store is maintained at more than 30; The ratio of male to female is also close to 2:1(38:20), including two elderly people and three foreign customers.

2) Deal.The turnover rate (more than 10%) of passenger flow in Xiaomi’s lower store is much higher than that of online website, and the joint sales of Xiaomi ecosystem products effectively drive the increase of customer unit price. Also in the half hour we observed: ① Joy City Store has accumulated 17 transactions, and the transaction conversion rate reached 28% (based on the number of customers entering the store); The customer’s unit price is about 302 yuan. In addition to the mobile phone, the products sold include charging treasure & headphones and other mobile phone peripherals, intelligent hardware such as sweeping robot & desk lamp, and daily necessities such as backpacks & suitcases. ② Wujiaochang Store has accumulated 9 transactions, the transaction conversion rate is 16% (based on the number of customers entering the store), and the customer unit price is about 469 yuan. Considering that Wujiaochang Store has only been opened for 2 months, the subsequent stores are mature and have location advantages (close to the university area), and there is a lot of room for improvement in store passenger flow and transaction.

3) commodity SKU.The SKU of Xiaomi Home Store is mainly based on Xiaomi and Mijia brand eco-chain products, and also includes a few eco-chain self-owned and third-party brand products, covering most products of Xiaomi technology lifestyle, but it is more selected than online. According to our on-site inventory: ① There are about 250 SKUs from Joy City stores, including 48 mobile phones (including the same model) and 8 TVs; ② Wujiaochang Store has about 180 SKUs, including 32 mobile phones and 8 TVs. New products such as Xiaomi MIX2 mobile phone, Xiaomi Kongjing 2S, AI audio and video are all synchronized, and the product prices and promotions are synchronized with online (for example, the store synchronized online to buy Xiaomi MIX2 mobile phone to send AI speakers).

4) shop assistant.Xiaomi Home Store does not undertake the after-sales service function of Xiaomi (there are also official and authorized service outlets), and there are many shop assistants, but their main work is product function introduction and shelf tally, and they rarely take the initiative to promote it. According to our on-site inventory: ① There are 17 on-site clerks in Joy City Store, including 2 cashier, 15 in-store service and tally, and several people in the warehouse who work in two shifts, with more than 40 employees in the whole store; ② There are 11 shop assistants in Wujiaochang Store, including 1 cashier, 10 in-store service staff and about 30 employees.

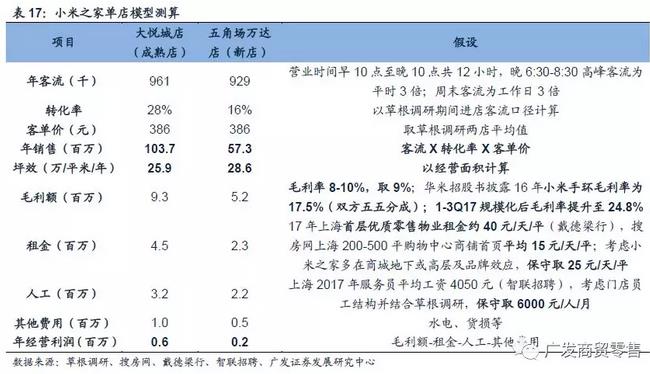

According to the field grassroots research, we calculate the annualized single store model of Xiaomi House, and the main assumptions include:

1) The business hours of the store are 12 hours from 10: 00 am to 10: 00 pm, in which the peak passenger flow at 18:30-20:30 pm is about 3 times as usual, and the passenger flow at weekends and holidays is 3 times as much as that on weekdays;

2) Taking mi band as an example, according to Huami’s prospectus, the gross profit margin of mi band’s sales in 2016 was 17.5% (Xiaomi and Huami shared the profits 50-50), and the gross profit margin increased to 24.8% after the scale of 1-3Q17. Considering that mi band is a mature star product, and its gross profit margin is higher than the overall level, combined with grassroots research, it is estimated that the average gross profit margin of store products is about 8-10%, taking 9%;

3) According to DTZ data, in 2017, the rent of the first-floor high-quality retail property in Shanghai was about 40 yuan/day/square meter, and the average listing rent of shopping centers and department stores in SouFun Shanghai was 15 yuan/day/square meter. Considering that Xiaomi House is mostly located in the underground or high-rise of shopping malls and the brand effect of Xiaomi, it is conservative to take the store rent as 25 yuan/day/square meter;

4) According to Zhaopin’s recruitment data, the average salary of waiters in Shanghai in 2017 was 4,050 yuan/month, and the recruitment salary of Xiaomi Home Store Manager was 140,000-210,000 yuan (Beijing). Considering the staff structure of Xiaomi Home Store and combining with grassroots research, the average salary of employees was conservatively taken as 6,000 yuan/person/month.

Based on the above grassroots survey data and main assumptions, we estimate:

① The mature store of Xiaomi Home (Joy City Store) has an annual passenger flow of 960,000 person-times, annual sales of 104 million yuan and annual floor efficiency of about 259,000 yuan (in terms of operating area); Gross profit is about 9.3 million yuan, after deducting 4.5 million yuan of rent, 3.2 million yuan of labor costs and 1 million other expenses (water and electricity, cargo damage, etc.), the annual operating profit is about 600,000 yuan.

② The annual passenger flow of Xiaomi Home New Store (Wujiaochang Store) is about 930,000, the annual sales is about 57.3 million yuan, the annual floor efficiency is about 286,000 yuan, and the gross profit is 5.2 million yuan. After deducting 2.3 million yuan of rent, 2.2 million yuan of labor and 500,000 other expenses, the annual operating profit is about 200,000 yuan. Considering the increase in passenger flow and conversion rate after the store matures, there is still much room for improvement in store sales and profitability.