[Pacific Auto Network, New Car Channel] Affected by many uncertainties such as the COVID-19 pandemic, even if the 2022 Beijing Auto Show has no choice but to announce the postponement, the rhythm of car companies’ new car releases will not be easily changed. In May, there are still many blockbuster models such as Landscape Dreamer (parameters Shu pictures) (inquire about reserve price | check participation), the new BYD Tang EV, and the new Ford Explorer. Without further ado, let’s have a first look!

New car preview to be launched in May Landscape Dreamer New BYD Tang EV New Ford Explorer Honda Fit Unlimited MUGEN Edition New Volkswagen Suiteng New Volkswagen Langyi Chery Tiggo 8 PRO Euler Ballet Cat mu-X Maki Ranger Gasoline Edition Suzuto Gasoline Edition

Landmap Dreamer

IPO time: May 7

As the second model of Lantu, the Lantu Dreamer is positioned as an MPV. The new car is based on ESSA’s native intelligent electric architecture, and continues to provide pure electric and range-extending hybrid power forms. According to official news, the new car will be officially launched on May 7, and delivery will be completed as soon as July.

In terms of appearance, the new car grille adopts a family-style design language similar to Landscape FREE, and the straight waterfall-style trim adds a lot of momentum to the vehicle. The integration of the through daytime running lights and the logo is also very delicate. The overall look and feel is full of momentum.

In terms of body size, the length, width and height of the new car are 5315/1980/1810mm respectively, the wheelbase reaches 3200mm, and the body parameters are even larger than Toyota Elfa. The overall scene appearance is very volume-sensitive. The design of the tail is relatively simple, and the popular through-type taillights are not used, so the visual effect is not so prominent.

In the interior part, the new car adopts the popular through-screen design, and a large number of leather packages are used in the interior as a whole, so there is not much to be picky about. In addition, the air-conditioning control area also adopts a touch-type interaction pattern, which can be described as both luxury and technology. At the same time, the new car will have 5G in-vehicle light-speed entertainment and office system, L2 + intelligent driver assistance system, and support OTA for the whole vehicle, which is also quite intelligent.

The interior of the Landscape Dreamer seven-seat version adopts a 2 + 2 + 3 seat layout, with the second row of independent seats. Officials said that the second row of seats has added adjustable leg supports and small table boards that can place objects to meet the comfort needs of the rear seat occupants, while the four-seat version has been officially unveiled at the Guangzhou Auto Show.

The new camel brown interior of Lantu Dreamer is also unveiled for the first time. The camel brown is paired with elegant black, combined with black marble lines and precision punching technology to create a luxurious and comfortable atmosphere.

In terms of power, the new car will launch the extended-range hybrid version for the first time, and then there will be a pure electric version. The 0-100km/h acceleration time of its electric four-wheel drive version is only 5.9 seconds. In addition, the front double fork arm rear multi-link independent air suspension system used in the chassis of the new car is equipped with CDC and magic carpet functions to scan, sense and identify special road conditions in advance, and actively adjust the suspension damping.

editorial review

Landmap Dreamer is positioned as a high-end luxury large MPV. Although the price has not been announced yet, from the product level, whether it is the size of the body, the materials and configuration in the car, it does meet this positioning. In addition, thanks to the advantages of the pure electric platform, its acceleration and intelligent performance have also kept up with the trend, surpassing the traditional luxury MPV in the market, and I am very much looking forward to its next performance.

New BYD Tang EV

IPO time: mid-May

The most obvious change in the appearance of the 2022 Tang EV is the front face. In terms of power, single-motor and dual-motor models are still available. In addition, from the previous exposure, the price of the car may start at 300,000 yuan.

The appearance profile of the 2022 Tang EV is basically the same as that of the current model. The biggest change is the design of the front face, which is the same as the silver decorative strip of the Han EV, which can effectively extend the horizontal visual width. At the same time, the "Tang" character relief in the center of the trim enhances a lot of delicacy.

Both sides of the front enclosure are designed with vents to reduce air resistance while also reducing wind noise. In addition, the LED light strip between the front enclosure and the lower grille is also equipped with a welcome light language function.

The sides of the car body have basically not changed. The length, width and height of the new car are 4900/1950/1725mm respectively, and the wheelbase is 2820mm. Except for the 30mm increase in length, the rest of the data has not changed. The new style of wheels uses a low wind resistance shape, and the specifications of the Michelin PS4 SUV tires are 265/45 R21.

The rear of the car is still designed with through taillights, and the rear enclosure is the main change in the rear of the car, which is basically the same as the design of the Tang DM and Tang DM-i.

The interior basically continues the layout of the current model, 12.3-inch full LCD instrument panel with 15.6-inch adaptive rotating central control screen, coupled with the "sky gray" interior color scheme, whether it is a sense of technology or grade are quite good.

In terms of intelligent configuration, the new car is equipped with DiLink 4.0 (5G) intelligent network system, which not only supports 5G speed connection, but also supports dual-frequency positioning and navigation technology. Of course, the Dipilot intelligent driving assistance system will not be absent, including D-holographic transparent imaging system, DiPilot steering wheel lane departure assist vibration reminder, DMS driver monitoring assistance, APA visual fusion full scene automatic parking and other functions.

In terms of spatial layout, the new car will have an additional 6-seat model, with a 2 + 2 + 2 seat layout providing a more comfortable ride experience. In addition to ensuring the comfort of the first row, the second row is also equipped with independent electric seats, which can support multi-directional adjustment, ventilation, heating, massage, and other functions.

In terms of power, the new Tang EV will launch three versions, among which the high-performance version is equipped with a dual motor with a maximum power of 180kW + 200kW, with an official acceleration time of 4.4 seconds; the other two models are equipped with a single motor version with a maximum power of 180kW.

In the battery life part, the new car will be fully equipped with BYD blade batteries, of which the single-motor long-range version has a range of 730km (CLTC), while the main performance of the dual-motor four-wheel drive version has a range of 635km (CLTC). Another two-wheel drive version with a slightly smaller battery can also reach a range of 600km (CLTC).

The NEDC mileage of the current model is 505 kilometers and 565 kilometers respectively. In the chassis part, the new car still adopts the front McPherson type and rear multi-link independent suspension, and this time it adds two adjustable suspension modes of comfort and sport.

editorial review

The adjustment of the car’s appearance is unified with BYD’s family-style design. Coupled with the upgrade of the configuration and the significant increase in the cruising range, it really brings full sincerity. However, with the increase in the price of upstream raw materials and other factors, the price of the car is expected to rise accordingly.

The new Ford Explorer

IPO time: May 20

Changan Ford’s new Explorer is a mid-term model. The biggest change is the use of a huge screen in the interior part, and the new car has also been optimized to a certain extent in the appearance part. From the information we have, the new car may be launched on May 20.

In terms of appearance, the new car adopts the latest 3D scale design, the size of the front grille has also been reduced, and the "EXPLORER" logo on the engine cover has improved the overall aura. In addition, the new car will no longer provide fog lights, and its grille is expected to support three shapes.

The rear part of the car has also undergone a major overhaul. The sturdy C-shaped light group has many similarities with the new Mondeo, and the recognition has also been improved. In addition, the horizontal chrome trim and the "EXPLORER" logo also echo the front of the car.

In terms of interior, the new car adopts a large-size through-type LCD screen design and adds a HUD head-up display function. In addition, the interior color scheme of the new car will provide four color schemes: pure brown, pure black, black brown and black purple.

In terms of power, the new car will continue to be powered by a 2.3T turbocharged engine with a maximum power of 276PS (203kW) and a peak torque of 425N · m, which is matched by a 10-speed manual transmission.

editorial review

As Ford’s flagship SUV, the Explorer, which has been selling well in the United States for many years, is the dream car of many off-road enthusiasts in China. Since its inception, the Ford Explorer has sold more than 8 million units worldwide, which shows its high popularity. After the appearance and interior of the mid-term model are optimized, it is believed that it will continue to maintain a high popularity.

Honda Fit Unlimited MUGEN Edition

IPO time: early May

On the basis of the new Fit GR9 model, the MUGEN version adds a large number of sports kits and is more visually sporty. It is reported that the new car may be officially launched in early May.

The Unlimited Special Edition is based on the fourth-generation Fit (GR9) model and adds a large number of MUGEN sports packages, including front and rear enclosures, spoilers, diffusers, and larger wheels. The rear of the new car is also marked with the "Limited MUGEN" logo, further highlighting the special identity of the model.

The front intake grille trim of the new car has also joined the MUGEN logo, which is more visually sporty. The side visual effect has also become fuller with the blessing of the kit, and the black wheel hub shape also brings a lot of sporty atmosphere to the side of the car.

In terms of the interior, the Infinite Special Edition did not add any special elements, and still continued the design of the ordinary version. Compared with the flamboyant exterior design, the interior is indeed a lot more low-key.

In terms of power, the Honda Fit Limited MUGEN version will be equipped with the "Earth Dream Technology" 1.5L direct injection DOHC i-VTEC naturally aspirated engine, with a maximum power of 96kW (131PS) and a peak torque of 155N · m, matched by a CVT transmission.

editorial review

As an official modified model, the car is more sporty with modified kits such as front and rear enclosures and rear spoilers, as well as the exclusive logo of MUGEN, which has attracted the attention of many fans. They hope that the price can also meet the title of "civilian supercar".

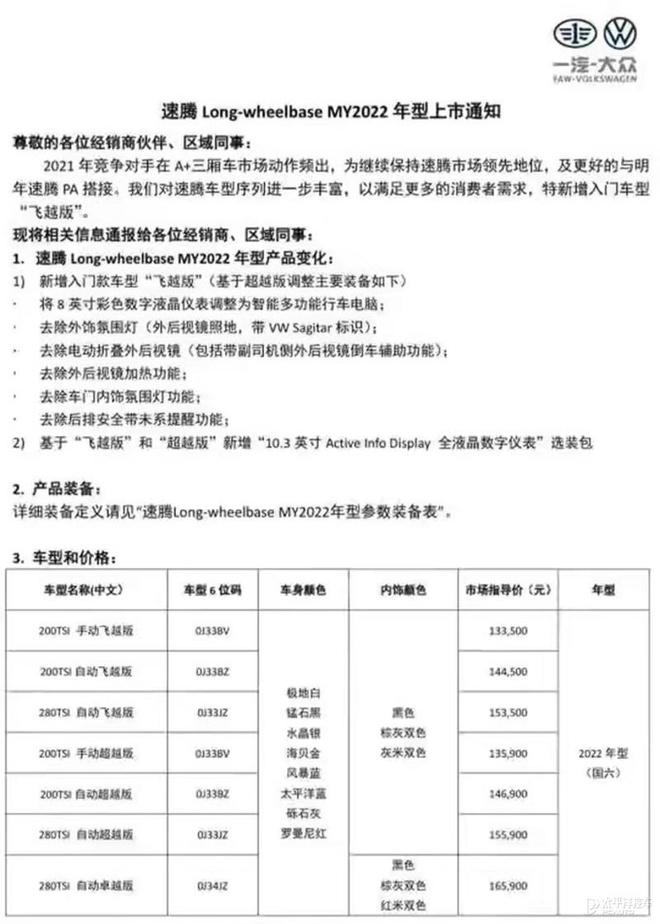

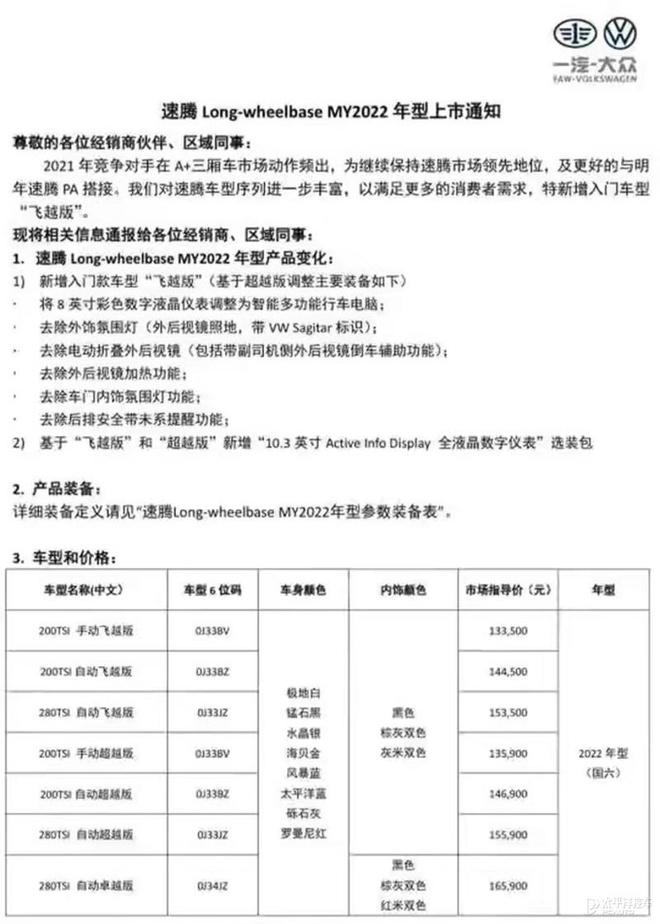

New Volkswagen Suiteng

IPO time: within May

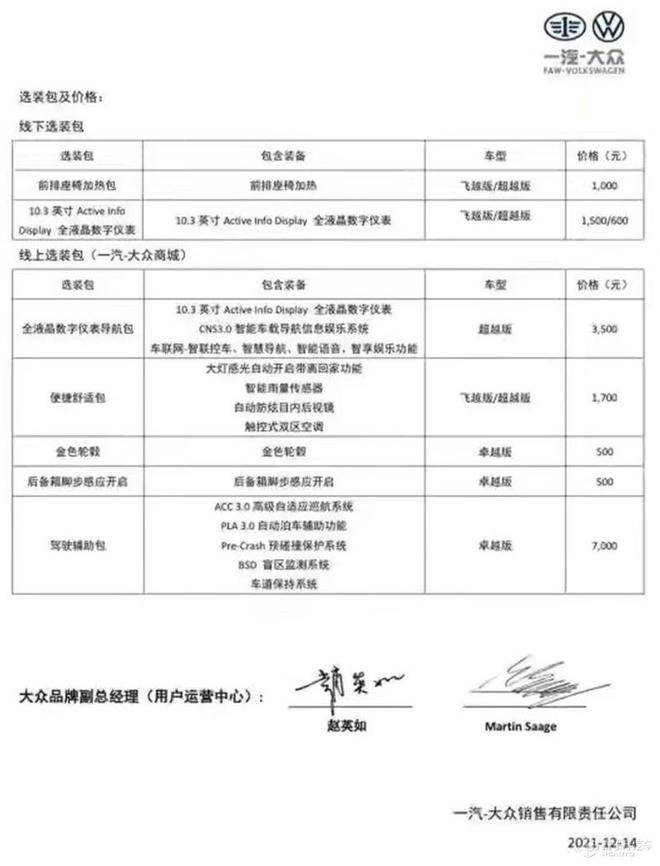

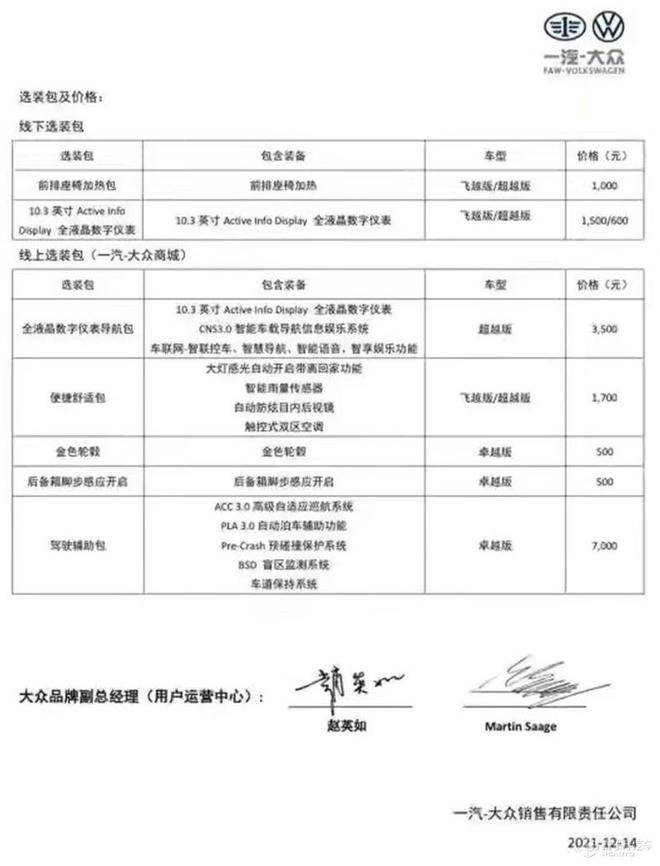

According to the information we have, FAW-Volkswagen’s new Suiteng will be officially launched in May. The new car may launch a total of 7 configuration models, priced at 13.35-16 5,900 yuan. In addition, the new car also adds 3 entry-level flying models to further meet consumer demand.

In terms of appearance color scheme, the new car provides 8 kinds of paint options such as polar white, manganese stone black, and crystal silver, and the interior part also provides a variety of two-color combinations. In addition, the new car also provides online optional packages and online optional packages, including full LCD instrument navigation package, trunk induction opening and driving assistance package.

In terms of appearance, the new car is basically the same as the current model in appearance, but in terms of details, the vehicle has a new style of front and rear bumpers, and the through design effectively extends the lateral visual width of the car. The interior of the air intake grille is decorated with dot-matrix chrome trim, which enhances a lot of luxury. In terms of body size, the length, width and height of the new car are 4791/1801/1465mm respectively, and the wheelbase is 2731mm.

In the interior, the new car is equipped with a new style of floating central control screen, and is equipped with a full LCD instrument, which looks more technological.

In the power section, the new car will have a brand-new 1.5T engine option, with a maximum power of 118 kilowatts. The matching or 7-speed dual-clutch transmission will be produced by the FAW-Volkswagen Chengdu factory.

editorial review

Although the appearance of the new Suiteng has changed little, it also makes its overall style more fresh. The most significant improvement is the launch of the 1.5T model. The new power is believed to be more satisfactory to the public than the 1.4T in terms of driving. It is reported that the 1.5T is not intended to replace the 1.4T. Three displacements will be sold at the same time, which means that the 1.5T may be launched as a sports model, which is worth looking forward to.

New Volkswagen Langyi

IPO time: within May

The official map of the new car has been officially released. As a mid-term model, the car offers a "double front face" shape option in appearance, and is equipped with a large-size floating central control screen.

In terms of appearance, the new car offers two front face shapes to choose from, among which the design of the star version is the same as that of the new Passat, the design of the headlight group is more sharp, and the internal grille of the star diamond shape presents a very sporty visual effect.

In addition, the Star Edition model is also equipped with a Black Sa dynamic rear wing and a blackened rearview mirror, which enhances recognition while adding a lot of advanced texture.

Entering the car, the new car is replaced with the latest floating design from the front embedded central control screen, and the horizontal two-color trim runs through the entire instrument panel, showing a unique sense of hierarchy. In addition, the new family-style steering wheel, air conditioner trend, instrument panel, door panel and other details are all decorated with dazzling silver texture chrome.

In terms of power, the new Volkswagen Langyi is still equipped with a 1.4T turbocharged four-cylinder engine with a maximum power of 150PS and a maximum torque of 250N · m. In terms of transmission system, the new car will be matched with a 7-speed dual-clutch transmission.

editorial review

The car adopts a double front face design with a new interior style, which makes the overall shape more delicate and changes the ancestral style of Volkswagen. However, the power of the car has not been adjusted, but this still does not affect Langyi’s position in the sales list.

Chery Tiggo 8 PRO

IPO time: within May

The new car adopts Chery’s latest design style and offers a 7-seat layout. In terms of power, the new car will launch 1.6T, 2.0T and Kunpeng DHT hybrid models at the same time.

The front face of the new car adopts the latest design style. Its X-shaped air intake grille and unique internal structure present a very dynamic visual effect. In terms of body size, the length, width and height of the new car are 4745/1860/1745mm respectively, and the wheelbase is 2710mm.

The taillights adopt a through-type design, which is basically the same as the design of Tiggo 8, but there will be differences in the shape of the lamp groups on both sides. In addition, the new car is also equipped with different exhaust layouts according to different models, of which the 2.0T model is equipped with a bilateral total of four exhaust, and the 1.6T model is a bilateral total of two exhaust design.

In terms of interior design, the Chery Tiggo 8 PRO integrates a futuristic "energy concept", providing young people with a stronger sense of technology through a full range of energy concept lights. The car is equipped with a 24.6-inch curved dual screen, and also features Chery’s first W-HUD head-up display function, which can display information such as vehicle speed, dynamic ADAS, navigation, phone, and SONY’s 10-speaker surround sound.

In the power part, the new car will launch 1.6T, 2.0T and Kunpeng DHT hybrid models at the same time, of which the 2.0T engine has a maximum power of 187 kilowatts, while the 2.0T model will be equipped with a four-wheel drive system. Kunpeng DHT hybrid models have 3 physical gears and 9 working modes, which can identify road conditions in advance and cover 11 car scenarios.

editorial review

As another new car in the Tiggo 8 family, the Tiggo 8 PRO has been upgraded in terms of appearance, interior and configuration while continuing the powertrain, forming a big difference with the Tiggo 8 and Tiggo 8 PLUS. However, the appearance of the car still cannot escape the homogeneous design, which lacks a lot of recognition. I hope it will be improved in the future.

Euler Ballet Cat

IPO time: mid-May

The Euler Ballet Cat is a rather personalized product under Euler, with a strong retro atmosphere, and is expected to be launched in May. In terms of power, the new car will offer two battery life versions of 401km and 500km for consumers to choose from.

In terms of appearance, compared to the punk cat previously unveiled, the ballet cat’s appearance details are more abundant, with the headlight set replaced with a rounded rectangular design and a new chrome front bumper shape. It will also be equipped with a front radar sensor.

On the side of the car, the rounded roof line with the roof line slides down quickly after the C-pillar, which allows enough head space in the car. In addition, the new car also adds the charging hole of the production car on the wing, the wheel rim style and the style of the rearview mirror have been adjusted, and the door handle has also been replaced with the traditional style.

The design of the rear of the car also echoes the good ji on the front face. The retro taillights and the wide chrome decoration present a very elegant style. In terms of body size, the length, width and height of the new car are 4401/1867/1633mm respectively, and the wheelbase reaches 2750mm.

In terms of interior, the dashboard and center console of the new car continue the connected screen design, but the round-sided rectangular style looks more coordinated and cute with the trend of air conditioners on both sides, combining the current popular design with the soft cute style. The retro-style steering wheel and seat shape further evokes people’s memories of classic cars.

In the power part, the new car’s drive motor can output a maximum power of 126kW, which is matched with a lithium iron phosphate battery pack, which can provide two maximum cruising ranges of 400km and 500km.

editorial review

From the model naming to the styling design, the Great Wall has caused the audience to be in an uproar again and again in the past two years. Dare to put such a retro styling shell on the production car, the strategy is really bold. For this retro electric car, there may be more interesting new products in the future. I wonder if you will buy it? What are your expectations for them? Welcome to discuss with us at the bottom of the comment area.

Mu-X Ranger Gasoline Edition

IPO time: May 10

The 2022 Jiangxi Isuzu mu-X Shepherd Ranger gasoline version model has been pre-sold in April, and the official pre-sale price range is 16-220,000 yuan. When it comes to the brand of Jiangxi Isuzu, I believe that the leather is durable, the loading and unloading capacity is strong, and it is stable and reliable. It is the first impression of many people.

Isuzu mu-X nomad, official pre-sale price model pre-sale price range (10,000 yuan) 2.0T gasoline version 16-22

Jiangxi Isuzu mu-X nomad has added orange and gray in appearance, and the overall styling style basically maintains the design language of the current model, but the 2.0GTDi logo can be seen at the rear of the car.

Jiangxi Isuzu mu-X nomad positioning medium-sized seven-seat SUV, using a non-bearing body structure, with a length, width and height of 4825mm/1860mm/1860mm, a ground clearance of 230mm, and a curb weight of 2.7 tons.

The interior of the new car will be equipped with a human-machine interaction system, which can provide mobile phone mirror projection and Keyword Spotting and automatic speech recognition functions. In addition, mainstream safety features such as Lane Departure Warning (LDW), Front Collision Warning (FCW), Front Vehicle Distance Warning (HMW), Rear Travel Warning (RCTA), Rear Collision Warning (RCW), Rear Collision Warning (RCW), Blind Spot Monitoring (BSD), Lane Change Assist (LCA), Door Opening Warning (DOW) functions will also appear on the new car.

In terms of other configurations, the new car will be equipped with EPB electronic parking, engine start-stop, wireless charging, as well as functions such as remote locking/unlocking of the vehicle, remote starting/shutting down of the engine, flashing lights to find the car/navigation to find the car, and remote turning on/off of the air conditioner.

In terms of power, the 2022 Isuzu mu-X Ranger gasoline version is equipped with a 2.0T engine from Ford, with a power of 162kW and a torque of 350N · m. The drivetrain matches ZF’s 8-speed automatic transmission, uses a time-sharing four-wheel drive system, and can also provide a limp mode (LHM).

editorial review

In terms of model positioning, the Mu-X Ranger is a hard-core SUV that focuses on practicality. Its product positioning is relatively more accurate and niche, but now that there are strong competitors like Nissan Tuda and the domestic Haval H9 in the market, I believe it will face considerable pressure. The next step is to look forward to its final pricing.

Suzuto gasoline version

IPO time: May 10

As a mid-market product of Jiangxi Isuzu, Lingtuo is the first choice for many Isuzu fans. The 2022 Jiangxi Isuzu Tuo gasoline version model is officially on pre-sale, and the official pre-sale price range is 13-180,000 yuan.

Isuzu Takashi, official pre-sale price, model pre-sale price range (10,000 yuan) 2.0T gasoline version 13-18

Isuzu’s new car is the second joint venture pickup model of Jiangxi Isuzu after D-MAX, and its products are positioned between Ruimai and D-MAX.

In terms of appearance, the new car adopts almost the same design style as the D-MAX, with a large number of chrome-plated decorations added to the front grille and connected to the light groups on both sides. The headlights are sharp in shape, and the interior is a split design for far and near light. The rear shape is also square, the rear parking radar appears as standard, and the reversing image is exclusive to high-end models. Its body size is 5295 × 1860 × 1775mm, and the wheelbase is 3095mm; the cargo compartment size is 1480 × 1530 × 480mm.

The interior adopts a more practical design style, following the design of D-MAX. In terms of configuration, it comes standard with front double airbags, cargo compartment treasure and side pedals. In addition, high-end models are also equipped with leather seats, central control color large screen and multi-function steering wheel.

In terms of configuration, the Lingtuo gasoline version will be equipped with many rich configurations including Bluetooth key & keyless entry, car-machine connected Carlife & Carplay, rear travel warning (RCTA), Bluetooth/car phone, four-door window automatic closing, dual main/passenger seat airbags, 360-degree surround view image, etc.

In terms of power, the new car is equipped with a 2.0T gasoline engine with a maximum power of 162kW and a maximum torque of 350N · m, which is matched with a ZF 8-speed manual transmission and can withstand up to 500N · m of torque.

editorial review

Jiangxi Isuzu is best known for their diesel engine. This time, they used the Ford JX4G20 2.0T gasoline engine to revolutionize the gasoline version. It is the product of the strong alliance between Jiangxi Isuzu and Ford. Looking forward to its follow-up product performance.

Full text summary

In previous years, March-May has always been the peak sales season of the automobile market in the first half of the year, with large-scale promotions at the end point and new cars appearing in turn. However, this year, due to the impact of the pandemic, the Beijing Auto Show has been postponed, and the listing of many heavyweight new cars can only be changed to online, but it still does not hinder our enthusiasm for watching cars. I believe that in the list of new cars listed in May, there is always a model that will make your heart beat. Welcome to leave a message in the comment area to interact! (Text: Pacific Automobile Network, Liu Yunqing)