CCTV News:According to the website of the Ministry of Commerce, on November 8, 2018, the Ministry of Commerce issued Announcement No.84 of 2018, and decided to impose anti-dumping duties on imported nitrile rubber originating in South Korea and Japan from November 9, 2018. The anti-dumping tax rates are 12.0% for Korean companies & mdash; 37.3%, Japanese companies 16.0%— 56.4%, the implementation period is 5 years.

On June 30, 2022, the Ministry of Commerce issued Announcement No.18 of 2022, and decided that ENEOS Materials Corporation would inherit the 16.0% anti-dumping tax rate and other rights and obligations applied by JSR Corporation in the anti-dumping measures of NBR. NBR exported to China under the name of JSR Corporation is subject to the anti-dumping tax rate of "other Japanese companies" in this anti-dumping measure, that is, 56.4%.

On September 8, 2023, the Ministry of Commerce received an application for the final review of anti-dumping measures submitted by Lanzhou Petrochemical Company of China Petroleum and Natural Gas Co., Ltd. and Ningbo Shunze Rubber Co., Ltd. on behalf of the NBR industry in China. The applicant claims that if the anti-dumping measures are terminated, the dumping of imported NBR originating in Korea and Japan to China may continue or recur, and the damage to China’s domestic industry may continue or recur, and requests the Ministry of Commerce to conduct a final review investigation on imported NBR originating in Korea and Japan and maintain the anti-dumping measures imposed on imported NBR originating in Korea and Japan.

According to the relevant provisions of the Anti-dumping Regulations of the People’s Republic of China, the Ministry of Commerce has reviewed the applicant’s qualifications, the relevant information about the products under investigation and similar products in China, the import of the products under investigation during the implementation of anti-dumping measures, the possibility of continued or reoccurrence of dumping, the possibility of continued or reoccurrence of damage and relevant evidence. The available evidence shows that the applicant meets the provisions of Articles 11, 13 and 17 of the Anti-dumping Regulations of the People’s Republic of China on industry and industry representation, and is qualified to file an application on behalf of the NBR industry in China. The investigation organ believes that the applicant’s claims and the prima facie evidence submitted meet the requirements of the final review and filing.

According to Article 48 of the Anti-dumping Regulations of the People’s Republic of China, the Ministry of Commerce decided to conduct a final review investigation on the anti-dumping measures applicable to imported NBR originating in South Korea and Japan from November 9, 2023. The relevant matters are hereby announced as follows:

I. Continue to implement anti-dumping measures

According to the suggestion of the Ministry of Commerce, the Customs Tariff Commission of the State Council decided to continue to levy anti-dumping duties on imported NBR originating in South Korea and Japan in accordance with the scope of taxable products and tax rates announced in Announcement No.84 of 2018 and Announcement No.18 of 2022 of the Ministry of Commerce during the final review investigation of anti-dumping measures. The anti-dumping tax rates levied on companies are as follows:

Korean companies:

1. Jinhu Petrochemical Co., Ltd. 12.0%

(KUMHO PETROCHEMICAL CO., LTD.)

2. (strain) LG Chemical 15.0%

(LG CHEM, LTD.)

3. Other Korean companies 37.3%

Japanese companies:

1. Japan Ruiong Co., Ltd. 28.1%

(Zeon Corporation)

2. 16.0% of materials of Yinnengshi Co., Ltd.

(ENEOS Materials Corporation)

3. Other Japanese companies 56.4%

Second, the review investigation period

The dumping investigation period of this review is from July 1, 2022 to June 30, 2023, and the industrial injury investigation period is from January 1, 2018 to June 30, 2023.

Third, review the scope of products under investigation

The scope of products reviewed is the products to which the original anti-dumping measures apply, which is consistent with the scope of products to which the anti-dumping measures announced by the Ministry of Commerce in Announcement No.84 of 2018, as follows:

Chinese name: nitrile rubber

English name: acrylic-butadiene rubber (NBR)

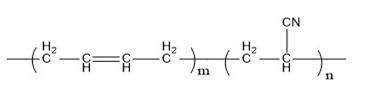

Molecular structure: (C4H6)m(C3H3N)n

Chemical structural formula:

Product description: NBR is a copolymer of acrylonitrile and butadiene monomer, and its appearance is gray-white to light yellow block or powder solid. It has excellent oil resistance, wear resistance, heat resistance and air tightness. The properties of NBR are affected by acrylonitrile content. With the increase of acrylonitrile content, the tensile strength, heat resistance, oil resistance, air tightness and hardness increase, but the elasticity and cold resistance decrease.

Main uses: NBR is widely used in various oil-resistant products because of its excellent oil resistance and physical and mechanical properties, such as O-rings, oil seals, hoses, hoses, gaskets, rubber rollers, soles, conveyor belts, and thermal insulation foam pipes.

This product belongs to People’s Republic of China (PRC) Import and Export Tariff: 40025910 and 40025990.

Fourth, the content of the review

The contents of this review investigation are: If the anti-dumping measures against imported NBR originating in South Korea and Japan are terminated, whether dumping and damage may continue or recur.

V. Register for the survey

Interested parties may, within 20 days from the date of this announcement, register with the Trade Relief and Investigation Bureau of the Ministry of Commerce to participate in this anti-dumping final review investigation. Interested parties participating in the survey shall provide basic identity information, the quantity and amount of products under investigation exported or imported to China, the quantity and amount of similar products produced and sold, and related information according to the Reference Form for Registration to Participate in the Survey. The reference format for registering for the survey can be downloaded from the website of the Trade Relief Investigation Bureau of the Ministry of Commerce.

Interested parties who register to participate in this anti-dumping investigation shall submit the electronic version through the "Information Platform for Trade Relief Investigation" (https://etrb.mofcom.gov.cn), and submit the written version at the same time according to the requirements of the Ministry of Commerce. The contents of the electronic version and the written version should be the same, and the format should be consistent.

The interested parties mentioned in this announcement refer to the individuals and organizations stipulated in Article 19 of the Anti-dumping Regulations of the People’s Republic of China.

Sixth, access to public information

Interested parties may download it from the website of the Trade Relief Investigation Bureau of the Ministry of Commerce or go to the Trade Relief Public Information Consulting Room of the Ministry of Commerce (Tel: 0086-10-65197856) to find, read, copy and copy the non-confidential text of the application submitted by the applicant in this case. During the investigation, interested parties may inquire about the public information of the case through relevant websites, or search, read, copy and copy the public information of the case in the trade remedy public information consulting room of the Ministry of Commerce.

VII. Comments on filing a case

If interested parties need to comment on the product scope, applicant qualifications, countries (regions) under investigation and other related issues, they can submit their written opinions to the Trade Relief and Investigation Bureau of the Ministry of Commerce within 20 days from the date of this announcement.

Eight, the investigation method

According to Article 20 of the Anti-dumping Regulations of the People’s Republic of China, the Ministry of Commerce can ask the relevant interested parties for information and conduct investigations by means of questionnaires, sampling, hearings and on-site verification.

In order to obtain the information needed for the investigation of this case, the Ministry of Commerce usually issues questionnaires to interested parties within 10 working days from the deadline for registration and participation in the investigation stipulated in this announcement. Interested parties can download the questionnaire from the website of the Ministry of Commerce and the sub-website of the Trade Relief Investigation Bureau.

The interested party shall submit a complete and accurate answer sheet within the specified time, which shall include all the information required by the questionnaire.

IX. Submission and processing of information

In the process of investigation, interested parties shall submit comments, answers, etc. through the "Information Platform for Trade Relief Investigation" (https://etrb.mofcom.gov.cn), and at the same time submit a written version according to the requirements of the Ministry of Commerce. The contents of the electronic version and the written version should be the same, and the format should be consistent.

If the information submitted by interested parties to the Ministry of Commerce needs to be kept confidential, they may request the Ministry of Commerce to keep the relevant information confidential and explain the reasons. If the Ministry of Commerce agrees to its request, the interested party applying for confidentiality shall also provide a non-confidential summary of the confidential information. The non-confidential summary shall contain sufficient meaningful information so that other interested parties can have a reasonable understanding of the confidential information. If you cannot provide a non-confidential summary, you should explain the reasons. If the information submitted by interested parties does not indicate the need for confidentiality, the Ministry of Commerce will regard the information as public information.

X. Consequences of Non-cooperation

According to Article 21 of the Anti-dumping Regulations of the People’s Republic of China, when the Ministry of Commerce conducts an investigation, the interested parties shall truthfully reflect the situation and provide relevant information. If the interested party fails to truthfully report the situation and provide relevant information, or fails to provide necessary information within a reasonable time, or seriously hinders the investigation in other ways, the Ministry of Commerce may make a ruling based on the facts already obtained and the best information available.

XI. Time limit for investigation

This survey began on November 9, 2023 and should be completed before November 9, 2024 (excluding today).

关于作者